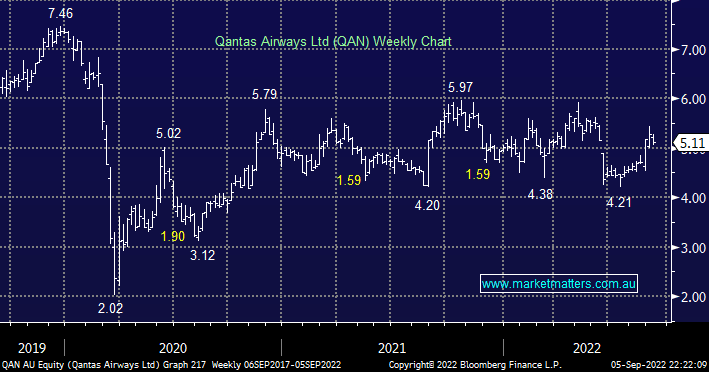

Australia’s flagship airline QAN has been trading around $5 for over 2-years with a couple of failed forays in both directions. The flying kangaroo delivered a significant loss last month for FY22 but the numbers were largely in line with expectations and they also launched a controversial share buy-back which helped the stock enjoy a minor relief rally.

- Domestic capacity has returned to pre-COVID levels with net debt coming in below QAN’s target, as a result, the board launched a $400m on-market share buyback which is clearly controversial given the government support QAN received during the pandemic.

Back in the dark days of September 2020, as QAN bled cash, they raised $1.36bn from an institutional placement plus $500mn from a share purchase plan, with new stock issued well under $4 which casts a mixed light on the board’s move last month but at least it should support the stock short-term.

- We see no reason to chase QAN around $5 although if pushed we see more upside than downside, but the overall trend is a muted one.