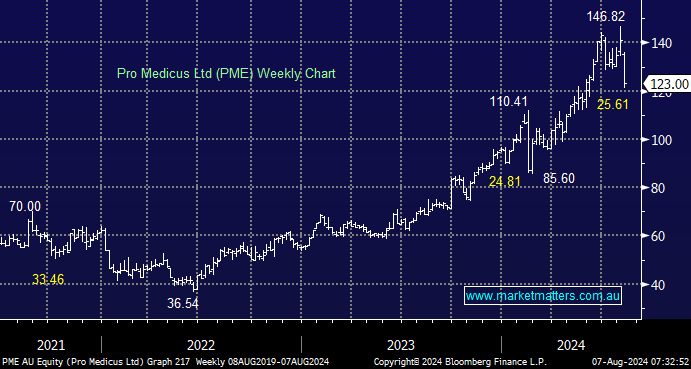

Medical imaging software provider PME has been enjoying solid success, which has contributed to the stock’s +28% advance year-to-date, even after the 15% decline over the last fortnight. For subscribers not familiar with PME, it’s now a $12bn business that generates revenue from software used in medical imaging practices made up of a subscription fee plus a small fee charged per each medical image done on its platform. In 1H FY24, its revenue grew 30% to $74.1 million, with an impressive operating margin of 66%. The company is debt-free due to its strong operating cash flows, which require little capital investment to operate. PME’s financials would be the envy of many ASX businesses, but a triple-digit valuation has meant many investors have missed out on recent gains, including ourselves.

- PME’s core product, Visage, is used by hospitals and radiology clinics to stream medical images to workstations and mobile devices, enabling them to make diagnostic decisions remotely.

This week, we have discussed buying top-quality stocks into weakness, and PME certainly fits the bill, especially after it received some attention from sellers yesterday after Jefferies cut it to a “Hold” with a price target of $120 – Tuesdays selling saw the stock fall 6.6%, to its lowest level in two months on triple its usual daily volume. Analysts are wary of PME missing lofty future growth targets as well as fresh competition from established players such as GE Healthcare, Philips, and Siemens. However, PME is years ahead of competitors in terms of its technology and continues to invest in maintaining this lead – perhaps it would be easier/cheaper for the likes of GE to buy PME, which is still 1/6 of its size.

In late May, PME announced that its wholly-owned US subsidiary, Visage Imaging Inc., had signed five new contracts in the US with a combined value of $45mn. The contracts bring the company’s minimum total contract value (TCV) for new sales this financial year to $245 million. PME’s multiple is one which needs growth to justify, but its cloud competitive landscape is delivering PME a competitive advantage, which was illustrated by these recent contract wins in the US. Founders CEO Sam Hupert and Anthony Hall still own 48% of the business, and subscribers know MM is keen on companies where management has “skin in the game”.

Supporters of PME believe future growth could come from expanding its target market by selling software to other speciality areas, such as cardiology. In the longer term, the company has developed an augmented reality app for Apple’s Vision Pro to replace workstations for radiologists examining scans and is exploring how to cash in on the AI boom in diagnostic software. History tells us this is a company at the forefront of its industry and is likely to deliver in the future.

- We like PME into current weakness as an exciting, high beta ASX healthcare/technology stock, but follow-through weakness towards $110 would not surprise – we have added PME to our Hitlist.