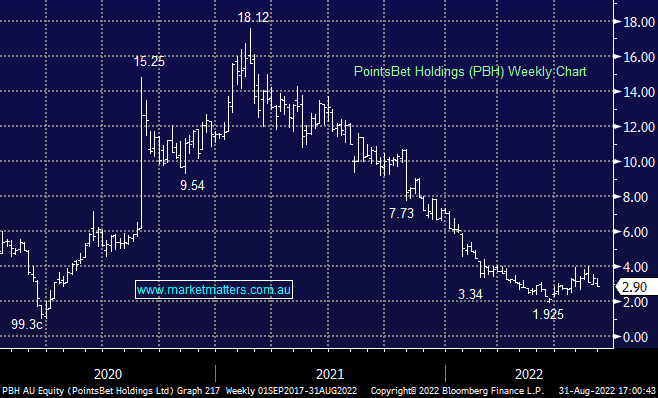

PBH -11.85%: a disappointing FY22 result from the wagering company today weighed on the stock price. Pointsbet has been spending money to grow aggressively and the marketing cost was nearly 80% of total revenue. This saw EBITDA miss expectations as losses widened to $243.6m despite a 52% increase in revenue. Cash grew to $472.7m, however, this relied on a $400m placement conducted at the start of the year, and an additional $94m top-up from SIG Sports in June. There was little in the way of guidance, as is normal for Pointsbet, however it was disappointing to not see any commentary around the SIG partnership or any progress in new markets since the start of FY23.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is frustratingly long PBH in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Why would MM sell DUB/PBH?

What’s MM’s longer term view towards PBH?

MM’s thoughts on PBH & DUB

MM’s view on PointsBet (PBH) & a2 Milk (A2M)

Thoughts on Aristocrat (ALL) and PointsBet (PBH)

Thoughts on Pointsbet & Nitro?

Do you think the current dip a good opportunity to add or build positions?

Codan (CDA) & PointsBet (PBH) – whats going on?

What stocks would we top up here?

Is PointsBet (PBH) worth a punt?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.