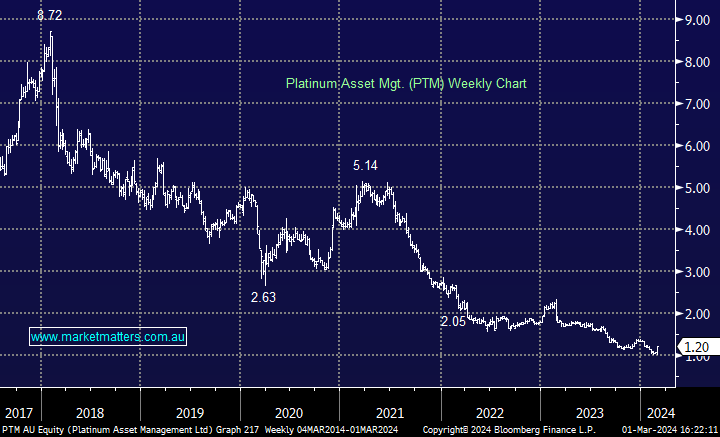

PTM +16.5%: rounding out reporting season, the fund manager announced HY results after market yesterday with some better-than-expected numbers taking it to 4-week highs. They have struggled with weak FUM flow numbers of late, however, a reduction in costs helped support earnings, EBITDA at $35.6m was ~4% better than consensus despite an in-line revenue number. The new CEO, in the role since mid-December, is looking to cut costs further in the 2H, streamlining the business before focussing on growth in FY25. Turning performance will be key now, that always leads to better FUM flows and they have some work to do here, their flagship fund returned 13.9% last year, 6.5% below the index.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM is neutral PTM

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.