GQG Partners is the 5th largest shareholder in tobacco company Philip Morris (PM US), owning 48.5m shares equating to 3.1% of the company, worth around $US7.8bn. PM is the world’s largest tobacco company owning bands like the iconic Marlboro, however, their future is more about smoke free products, and they’re aggressively pivoting towards this area, which include heated (rather than burnt) tobacco, vapes and oral pouches. At their quarterly results last week, 41% of net revenue came from these areas, and by 2030, they aim for over 60%. The US FDA describes these products as ‘Modified Risk’ products, rather than safe, which just means they are potentially less harmful than smoking because they remove combustion, but they haven’t been around long (10-15 years) and the jury is still out. In Australia, these products are banned, but in reality, they are making their way illegally into the market (VEA’s result yesterday, and MTS recently is testament to that).

Putting that debate to one side, PM is a very defensive, established business, operating globally, that is pivoting into an area of growth. In the 2Q25 (results out last week), they reported net revenue of $US10.14 billion, up 7.1% year-on-year, but slightly below expectations (~$US10.3bn). They did beat on earnings, which were up 26.6% YoY, producing earnings per share (EPS) of $US1.95. Combustible tobacco sales amounted to ~$6.0 billion, up 2.1%, despite a 1.5% decline in cigarette shipment volumes, with smoke-free product revenue hitting US$4.2 billion up ~15.2% YoY. They also increased full-year 2025 adjusted EPS guidance to $7.43–$7.56 per share, up from the previous range of $7.36–$7.49

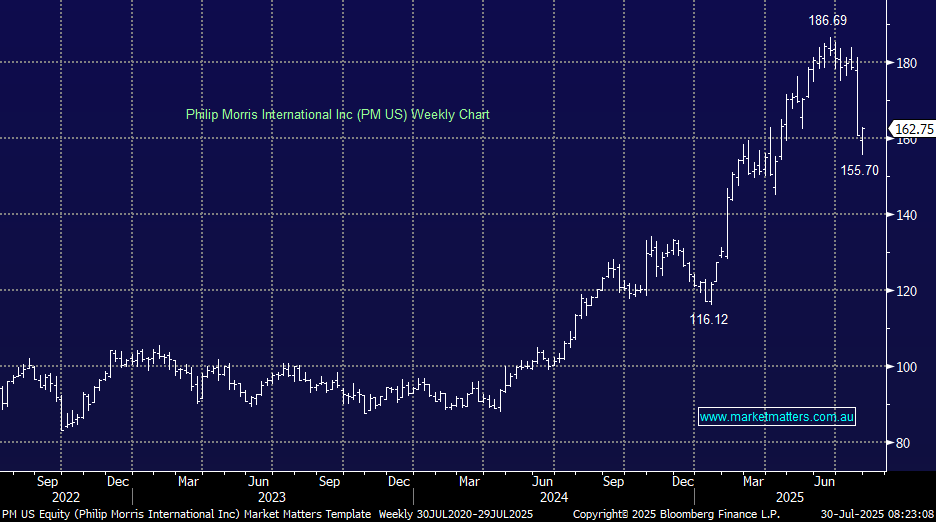

The slight revenue miss, but more importantly, slower than anticipated growth for ZYN (their oral business) saw the stock sell off ~13%, into a solid risk/reward area ~$US160/sh. Trading on 20x earnings, with those earnings growing at ~12% per annum in the forecast period (3-years), with a strong level of certainty, PM is a solid investment, and we can understand why GQG has it in their portfolio. From a broker perspective, we see 12 buys, 6 holds, no sells with a consensus price target of $US185.16.

- We appreciate some members will not be keen on this stock, and that’s understandable. However, at MM, we’ve always seen our role as investment-focused without applying our own ethical biases to readers.