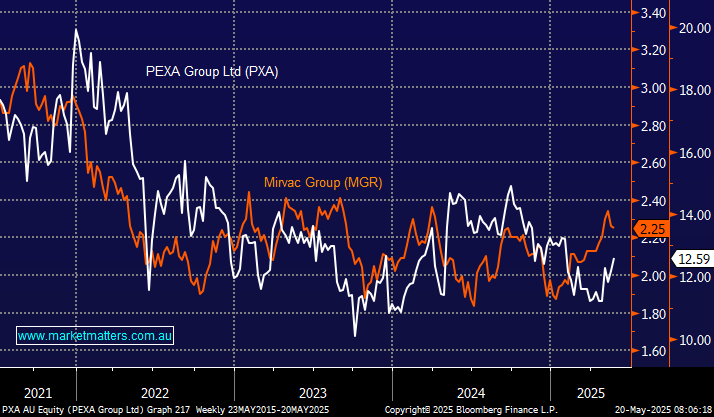

This morning we’ve revisited two very different company’s exposed to the property sector as the RBA are poised to cut rates this afternoon:

- Pexa (PXA) – PEXA operates the leading digital property settlement platform in Australia, handling property transfer and refinancing transactions. Its third-quarter result was mixed.

- Mirvac (MGR) is a diversified property group that has performed stoically through 2025, but its April trading update disappointed some analysts as it left guidance unchanged.

MGR is up +20% YTD, and while we believe its advance is mature with rate cuts and a healthy property market built into its share price, its 4.7% yield remains supportive—its next dividend is paid in June. Conversely, PXA is down ~4% YTD, although this is definitely not a reason to go long. It’s a stock we like, and any signs of a pick-up in the UK will flag it as a potential option for our Active Growth portfolio.

- We are unlikely to switch at the moment, but it’s on our radar.