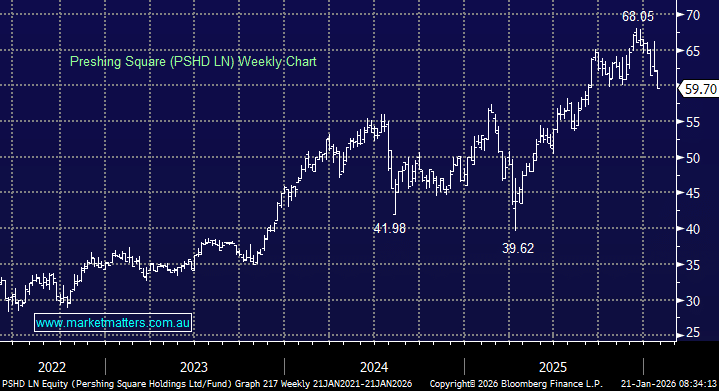

Pershing Square has been held in the International Equities Portfolio since midway through 2023 and has been a strong performer, up over 60%. It is a Listed Investment Company (LIC) trading on multiple exchanges. We originally bought on the OTC market in the US, however, there have been some changes and it’s now being held via the London Stock Exchange (LSE) listed under code PSHD, where it trades in $US. For members looking to buy Pershing Square, we now suggest doing via London, which is where we hold our position through MM Invest.

Mechanics aside, we still believe Pershing represents good value, with the LIC trading at a near 30% discount to the value of its underlying portfolio. As a refresher, Pershing Square is the highly concentrated global equity fund run by Bill Ackman, investing in a small number of high-quality, cash-generative businesses with long growth runways.

In recent times, it seems like they are trying to move more towards a Berkshire Hathaway style, with Ackman making moves that sound Berkshire-like, most notably his bid to increase control of Howard Hughes Holdings with the explicit intention of evolving it into a diversified holding company that could acquire operating businesses permanently. While this might be the intention, it is not the case today; Berkshire Hathaway owns operating businesses (insurance, utilities, railroads, manufacturing) – Pershing owns only public equities and does not generate operating cash flows like Berkshire’s insurance float or owned subsidiaries – but we do think they will move down this path in the future.

As it stands (last available filing was Sep Quarter 2025 – Dec will be out soon), the ~$US15bn portfolio looks broadly like this:

- Uber Technologies Inc. (UBER) – largest position (~20%)

- Brookfield Corporation (BN) – second largest (~19%)

- Howard Hughes Holdings Inc. (HHH) – ~10-11%

- Alphabet Inc. (GOOG) – ~10-11% (Class C shares)

- Restaurant Brands International Inc. (QSR) – ~10%

- Amazon.com Inc. (AMZN) – ~8–9%

- Alphabet Inc. (GOOGL) – second share class of Alphabet (~8%)

- Chipotle Mexican Grill Inc. (CMG) – ~5–6%

- Hilton Worldwide Holdings Inc. (HLT) – ~5%

- Seaport Entertainment Group Inc. (SEG) – ~0.7–0.8%

- Hertz Global Holdings Inc. (HTZ) – ~0.7%

We have some overlap with our own portfolio, notable in Google and Chipotle, but we’re comfortable with that. The reason to own Pershing is fairly simple – we can buy this portfolio at a near 30% discount to its value, benefiting from upside in the shares, and (hopefully), closure or partial closure of the gap between the current price and Net Asset Value (NAV). The 2nd point is mildly contentious – they’ve been trading at a discount for a long time, and while there have been periods where the gap has closed, it hasn’t been sustainable. We spoke with Geoff Wilson about this last year, who met Bill, though he said the meeting was very brief, and Bill was not overly responsive!

In any case, we do believe Pershing is working to address the discount that is now back to near its largest in the past 12 months. Buying $1 of share value for 70c remains compelling, but only if the manager is good, performance stacks up, and there is a clear path for the gap to close – we think Pershing fits these criteria.

We remain comfortable holding Pershing Square as a core international equity exposure. The portfolio is concentrated, high-quality and actively managed, with strong transparency. The only real caveat being that the fee structure is high, at 1.5% plus a 16% performance with no benchmark – i.e. an absolute return benchmark. This means that in a strong market, they can underperform major indices but still accrue performance fees, but equally, if the value of the portfolio declines irrespective of relativity, no performance fee is payable.

All said, there are some complexities in this holding, but we believe the value continues to justify our position.