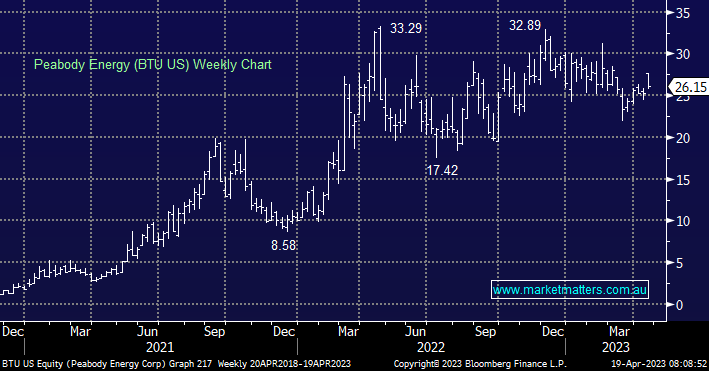

Peabody is a global coal producer with operations in North America & Australia and is about 10% smaller than Whitehaven Coal (WHC) from a market capitalisation perspective. Inline with our bullish stance towards Coal over the coming 12 months, we are bullish on Peabody, however, we will review their quarterly update set to be released on the 27th of April before potentially adding it to the portfolio. We do have coal exposure in the portfolio via Glencore (GLEN LN), however, this is more diversified in nature. GLEN has proposed an all-share merger between itself and Teck, with a simultaneous demerger of the combined coal businesses, however, it seems there may be others that also see the rationale of such a deal and could join the fray. We are of the opinion that Coal exposure for the portfolio may be better serviced through a pure-play operator, rather than a diversified global player who has flagged their desire to instigate deals.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

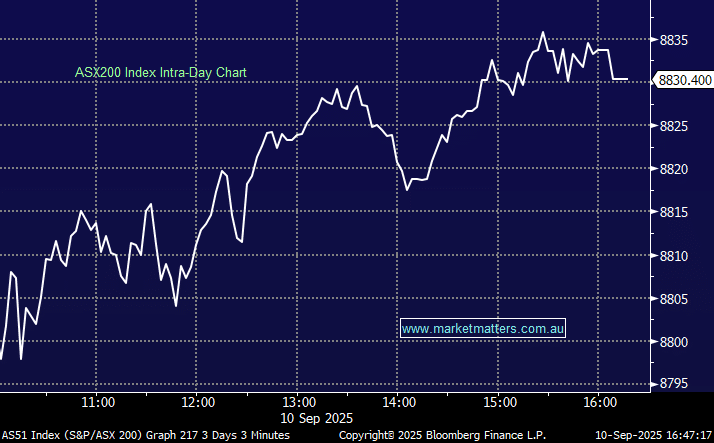

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monday 8th September – Dow off -220pts, SPI off -15pts

Monday 8th September – Dow off -220pts, SPI off -15pts

Close

Close

MM is bullish BTU US ~$US26.00

Add To Hit List

In these Portfolios

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Monday 8th September – Dow off -220pts, SPI off -15pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.