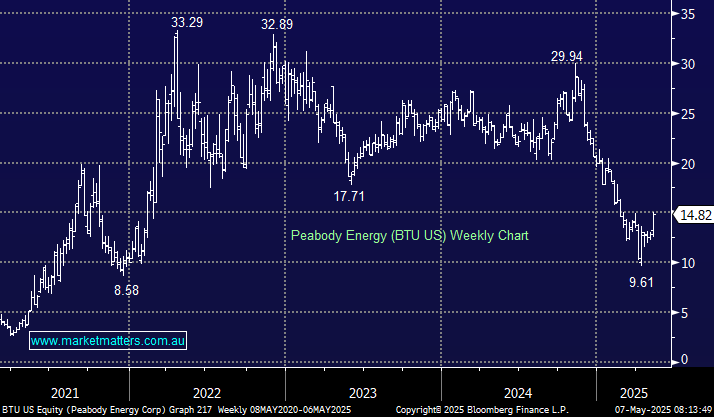

Coal stocks globally have been in a challenging spot for the past 6-months, with most down to the tune of 30-50%, with BTU US being on the weaker side. We’ve held various positions across all portfolios, and they’ve weighed on performance. Our expectation that weaker supply would meet higher demand, pushing up prices, has proven elusive. However, we firmly believe that now is not the time to fall on our sword and Peabody’s overnight result and share price reaction (+10%) is another sign the worm is turning.

1Q25 results released overnight were solid, well above expectations and highlight that BTU is managing the lower coal price environment better than many expected;

- Quarterly revenue of $US937m was only down 4.4% year on year, in line with expectations

- Better control on costs drove a big beat to earnings, with underlying earnings (EBITDA) of $US144m well ahead of $US92.5m expected.

- Cash of $US696.5m was ~$50m ahead of forecasts, and they maintained capex guidance of $US450m against market expectations nearer $US500m.

- Full year production guidance was maintained, and their Q1 run rate of 28.9m/t was strong.

Peabody’s coal production is predominantly thermal coal, though the company is actively shifting its focus toward metallurgical coal, much like Whitehaven has. They are (or were) in the process of buying Met Coal assets from Anglo American for $US3.8bn, however, the Moranbah North coal mine located in Queensland’s Bowen Basin, which is a significant component of the deal, has stopped production following a fire in the underground mine which has put the acquisition into question. Peabody says that the fire constitutes a “material adverse change” and is considering withdrawing from the deal if the issues at the mine are not resolved within the agreed timeframe. This is understandable, or at the very least, the incident can be used to leverage a better deal for BTU.

- Ultimately, we remain optimistic about coal’s outlook despite the challenging last 6-months.