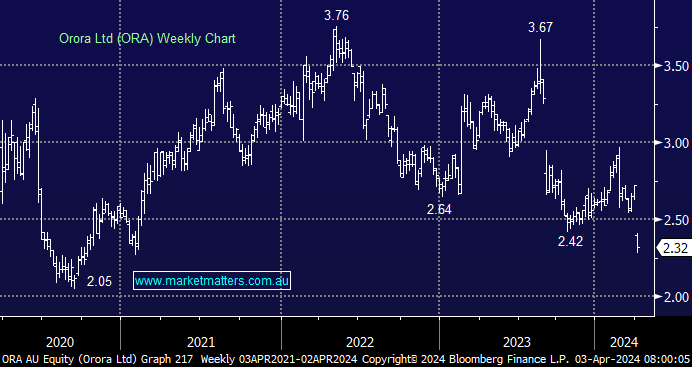

A disappointing update from the packaging company yesterday where they downgraded FY24 earnings guidance only 6-weeks after they reported 1H24 results (at which time they maintained guidance). We own the stock across the Active Growth & Active Income Portfolios with the 14.71% fall taking around 0.7% from portfolio performance yesterday, and proving our thesis is wrong on the stock.

There are two components to this business, the existing operations comprising Australasia and North America and the recent acquisition of Saverglass in Europe., which makes high end spirit bottles for the likes for Grey Goose and Glenfiddich. While the stock has been under pressure for a while, weighed down by the market’s expectations of softer earnings from Saverglass, it was a surprise to see the North American distribution business struggle, and this was the main reason for the share price reaction in our view.

At the group level, market consensus was for $423m in earnings before interest & tax (EBIT) in FY24, after yesterday’s update, we now forecast ~$390m which is an 8% downgrade, and we think the market will be similar. The ~15% share price decline yesterday then seems severe (about 2x the earnings decline), especially for a stock already trading on a cheap multiple (13x); however, ORA expects leverage to be around 2.8x at FY24, which is elevated and is increasingly in focus given a more uncertain earnings growth outlook.

- We are now considering our positions in ORA across two portfolios, with gearing becoming as an issue on greater earnings uncertainty, we are likely to cut and run as any recovery will take time.