Global packaging company ORA, which manufactures and supplies glass bottles, aluminium cans, and custom packaging solutions to the beverage, food, and industrial sectors, has been on a fascinating journey over recent times. While buying stocks looking for takeover to come is often fraught with danger, we do view ORA as a legitimate candidate for some corporate interest. A quick recap on events over the last few years, including our failed foray into the stock last year:

- Orora acquired French company Saverglass SAS, which makes high-end spirit bottles for the likes of Grey Goose and Glenfiddich, in September 2023, for $2.15bn – at the time the bid was regarded as a full-to-expensive price, and the stock plunged ~20% over a few weeks.

- We bought ORA for our Income and Growth Portfolios in early 2024, believing value had presented itself after its sharp decline post the large European acquisition.

- We relatively quickly exited in April of the same year, around $2.30, following a disappointing downgrade – a good move in hindsight, illustrating that taking losses can add value to portfolios.

- In August of 2024, ORA received an informal bid from American $US92bn private equity firm Lone Star at $2.55, who, interestingly, was also trying to buy France’s Saverglass in the previous year, albeit at a lower price.

- ORA’s board subsequently rejected the bid, saying it “materially undervalued the company” – for investors, the wrong decision, something ASX participants have witnessed too often in recent years.

ORA is now trading ~22% cheaper, and the company is starting to turn around, suggesting it would be an ideal time for a suitor to buy, or reconsider the $2.5bn business.

- In August, ORA delivered a solid result with earnings beating expectations thanks to a positive surprise from Saverglass, perhaps $2.15bn will prove an ok price.

With ORA’s recent result beating expectations and importantly with Saverglass driving the result, weakness on concerns around the huge ~$2.2bn acquisition is starting to look off point. Although ORA has bounced since March, it’s still trading on the cheap side compared to the last few years, when we believe, if anything, it should now be on the other side of the ledger, supported by its 5% yield and the M&A potential. However, we shouldn’t get carried away, revenue is only set to rise 5% to $2.2bn in FY26, with its Australasian glass business volumes having been under pressure for some time due to declining beer and commercial wine markets domestically.

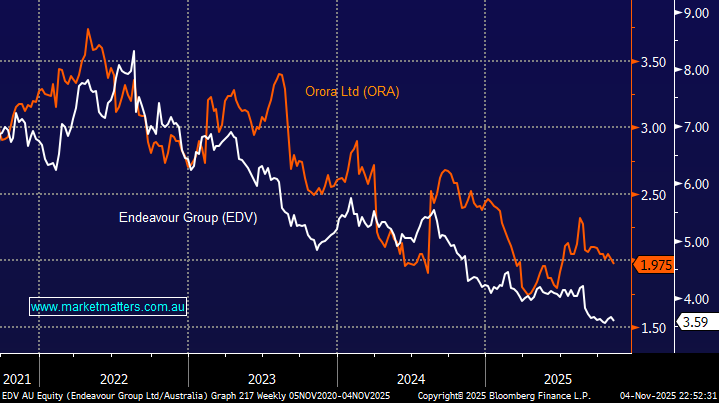

This led us to consider other liquor-exposed stocks in Australia, with Endeavour (EDV) coming to mind. It’s also endured a tough 2025, declining 14.5% year-to-date, less than ORA’s 19.7%. EDV owns major bottle shop brands like Dan Murphy’s and BWS, and manages a large network of pubs, bars, and clubs across the country. With the younger generation drinking less alcohol, we must consider if this structural shift makes these 2 stocks simply too hard being exposed to a market in structural decline:

- For EDV, alcohol equates to more than 80% of its total revenue, whereas ORA has a much smaller proportion of its revenue from alcohol‑related business, less than 40%, and within one of its sub-segments (cans), only ~27% is alcohol‐related.

ORA is clearly not as dependent on booze as EDV, plus it should be easier to migrate the business further away if required, although at this stage their share prices are dancing a pretty good tango.

We like ORA below $2 but it looks unlikely to set the world on-fire without a suitor emerging which is a definite possibility, but not reason on its own to buy the stock.

- We like ORA as a relatively high-yielding defensive play, but it’s not making it onto our Hitlist yet.