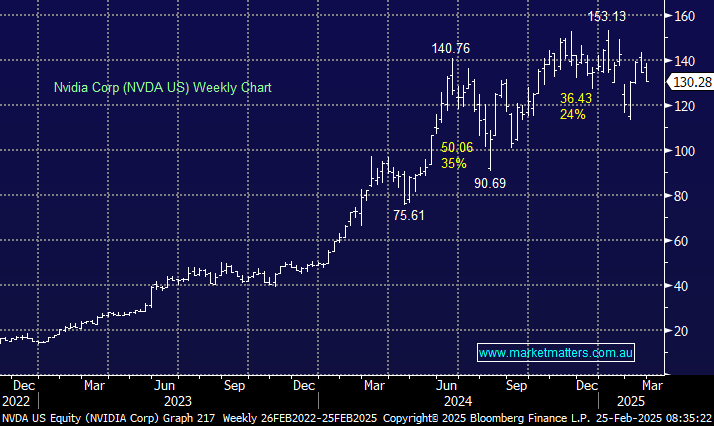

NVDA has become the flagship of the first chapter of the AI evolution, with the company swelling to a $US3.2bn behemoth in just a few years. The numbers coming out of NVDA have been astounding in recent years: in 3Q25, Nvidia reported record Data Centre revenue of $US30.8 billion, representing a 112% year-over-year increase. Total revenues reached an all-time high of $US35.1 billion, while net profit grew by 108.9% to $19.3 billion. However, there are always two sides to an equation, with analysts very bullish on the stock; over 80% have a Strong Buy on Nvidia, leaving room for disappointment.

- We expect the stock to move between 5 and 10% following the result; hence, we would rather sit back and digest the numbers – MM has NVDA on its Hitlist for our International Equities Portfolio.