Nvidia’ s 1Q earnings numbers and importantly outlook have initially been well received with the stock climbing ~5%:

- 1Q revenue of $US44.1bn beat estimates of $US43.29bn.

- 1Q Adj. EPS was 96c beating Est. of 93c.

- Guidance the key for this as always, and to that end they see 2Q revenue of $44.1 billion to $45.9 billion, inline with expectations.

The result was particularly impressive given export controls, a headwind set to continue. Year on year, top-line growth of 69% surpassed the US$ 39.3 billion sales record set in the previous quarter. However, we note the 61% gross margin was its weakest since 2022 as they invest in new products , but we expect this to recover by the year’s end. For the Data Centre companies on the ASX, it was encouraging to see NVDA’s DC revenue grow 10% from the previous quarter, and 73% year-on-year.

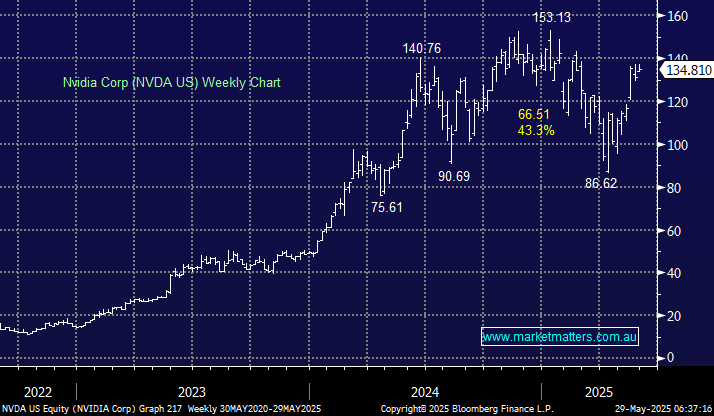

- We can see Nvidia testing $US160 into Christmas, but $US140-150 area might hold it for a while depending on how Trumps restrictions on chips going into China plays out.