The $US570bn Danish manufacturer of Ozempic has transformed the weight loss space and the Danish economy in one fell swoop, though earlier on the week, NVO disappointed the market with its report. Earnings before interest and tax came in at 25.93 billion Danish kroner in the second quarter, which was also below the LSEG forecast of 26.86 billion Danish kroner. On the day, shares of NVO initially tumbled almost 7% before paring back losses to finish down 2.7%, an illustration that investors still have appetite for the space.

- On Wednesday, Novo Nordisk said its net profit was 20.05 billion Danish kroner ($US2.93 billion) in Q2, below forecasts.

- The pharmaceutical giant also trimmed its operating profit outlook for the full year 2024, saying growth was now anticipated to come in between a 20% and 28% range.

We believe investors should stay with the strength, preferring LLY over NVO.

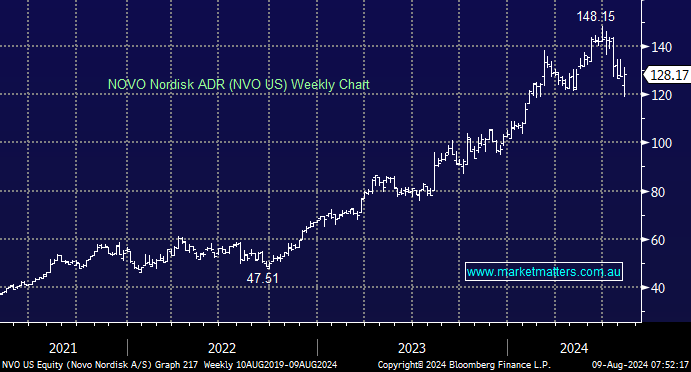

- We like NVO into weakness around $US120; its chart is a mirror of LLY as the industry’s main players largely trade as one.

NB: As with many companies, they trade in the US as well as their home exchange via American Depository Receipts (ADRs), similar to our own BHP.