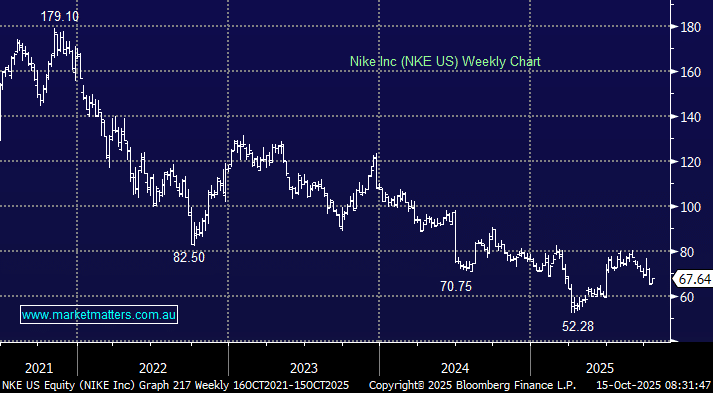

We don’t currently own Nike, but we think it’s one of the more interesting large-cap consumer names on the radar — a global brand with extraordinary equity, trading at a point in its cycle where sentiment is washed out and earnings remain depressed. The question is whether it has the potential to be one of the great large-cap consumer turnarounds. This is not the first time we’ve asked the question – we keep coming back to the stock, though we haven’t yet pressed the buy button.

Nike remains a market leader in the high-growth athletic footwear and apparel space — an industry dominated by a handful of players (Adidas, Puma, On, Hoka) where scale and brand matter. With over 50 years of brand equity, Nike’s positioning and consumer mindshare are virtually unrivalled. That dominance creates formidable barriers to entry — but it hasn’t spared the business from execution missteps in recent years.

- A lack of new product innovation and years of chasing seemingly higher direct-to-consumer margins by selling through the Nike-branded store network and Nike.com, at the expense of wholesale channels, cost them dearly. Margins have compressed sharply, weighed down by inventory overhangs, promotions, and shifting consumer trends.

Nike has now gone back to the future to rebuild the business, bringing back 32-year Nike veteran Elliott Hill. Hill introduced a “Win Now” strategy: a back-to-basics focus on performance sport, premium product, and core wholesale partnerships, aiming to rebuild trust with major partners while scaling back over-distributed lifestyle franchises like the Dunk and Air Force 1. Promotions are being reduced, and marketing dollars are being reallocated toward sports categories such as running and basketball — where Nike once dominated.

We think Hill’s approach is a good one — acknowledging where Nike lost focus (overreliance on retro lifestyle shoes, underinvestment in innovation, and alienation of key retail partners) and re-anchoring the brand in sport and product development. Current margins are running at depressed levels, leaving meaningful scope for expansion if the strategy works — we believe they could more than double from here in a successful recovery scenario.

Analysts are starting to warm to the turnaround, which is in its early stages. Running specialty sales were up mid-single digits in recent months, led by success in the Pegasus and Vomero 18 lines. The new AirMax DN8 launch has been well received in Japan and Korea, and just rolled out in the US, while the Nike x SKIMS collaboration has generated buzz across digital and social channels.

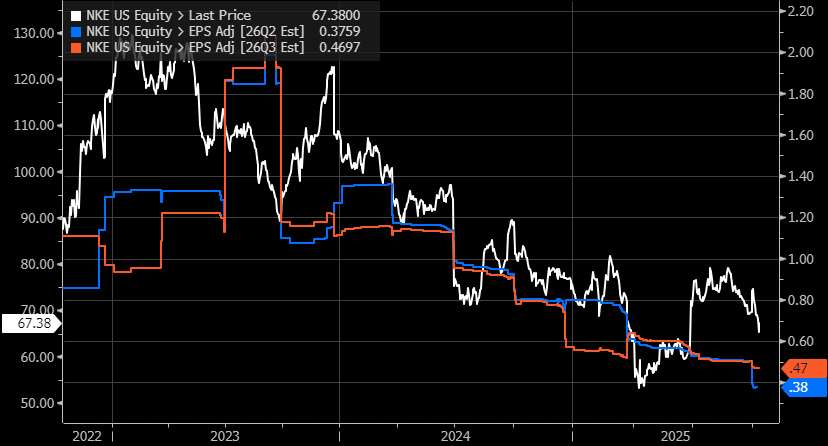

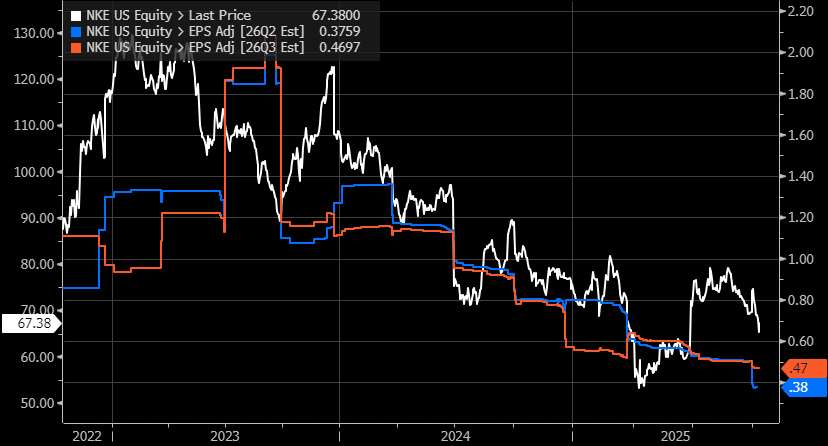

- Still, it’s too early to call an earnings recovery, and we’re not yet seeing any meaningful consensus upgrades. The chart below plots consensus EPS for 2Q26 (ending Nov 30), and then 3Q26 (ending Feb 28). There is a slight improvement in expected EPS QoQ, but there is no clear sign that earnings have bottomed.

Consensus sees broadly stable revenue but lower near-term margins, impacting earnings. The path forward depends on execution — delivering innovation at pace, refreshing product ranges, and re-energising consumer engagement in China and North America, both of which remain patchy.

While we’ve come to the same conclusion a few times, Nike isn’t there yet, but the turnaround is close at hand (we think). The earnings line remains soft, and near-term headwinds (tariffs, margin pressure, choppy China) persist. But it’s a stock that now screens as “interesting” for patient investors. The combination of world-class brand equity, a credible new CEO with deep institutional knowledge, and significant latent margin potential gives Nike the ingredients for a high-quality turnaround story.

- Nike is being added back onto the Hitlist for the International Equities Portfolio