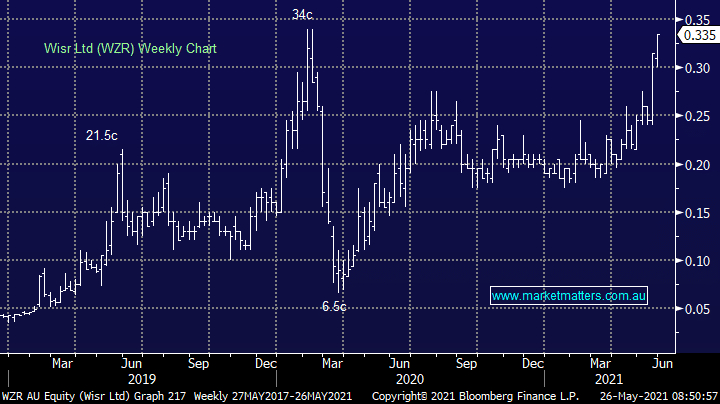

A new non-bank lender hit the ASX boards yesterday. It was a tough debut for Pepper Money (PML), falling -9.96% though it traded more than 16% below its IPO price at one stage of the day. Pepper Money splashes in the same puddles as one of our key holdings in the portfolio being Wisr (WZR), which we are sitting on a paper profit of 24%. Pepper Money focusses on larger loans with mortgages in Australia & New Zealand accounting for 75% of their operating income. The remaining quarter is largely car and equipment finance. There is no doubt it’s a larger operation, but it doesn’t mean it’s a better one. Wisr’s key difference to Pepper Money – other than it not offering home loans – is it’s technology platform and while Pepper Money is cheap (listing on less than 11x earnings and an expected yield of 3.3% at the IPO price according to the prospectus), it doesn’t have the growth profile of WZR – we see it as a more mature business without a compelling differentiator in a competitive space.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

Related Q&A

WZR

Switching from Wisr to Liberty?

What’s up with Wisr (WZR)?

Australian Strategic Materials & Wisr- MM’s take

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.