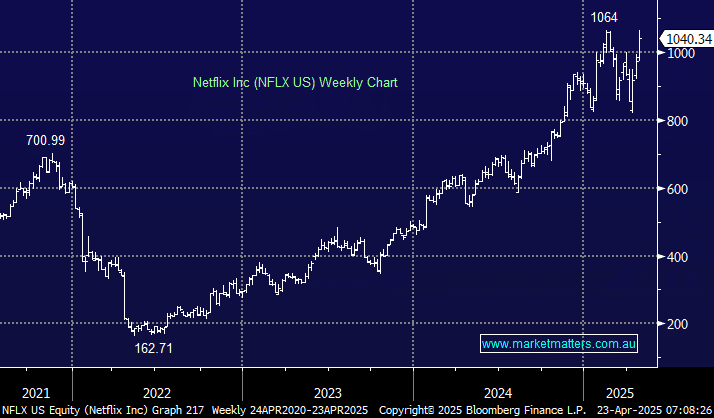

Netflix (NFLX) has become a household name as the global leader in subscription video streaming. Last week, the company delivered a solid earnings beat for the first quarter, which has propelled the stock to fresh all-time highs:

- Revenue $10.54 billion grew 13% during the first quarter of 2025, slightly ahead of expectations.

- Earnings per share of $6.61, Est. $5.71, up 25% from last year’s quarter.

- Operating margin of 29% remained robust.

NB: The report marked the first time the streaming giant did not disclose quarterly subscriber data, as it shifts its strategy to focus on revenue and other financial metrics as performance indicators.

The streamer attributed its better-than-expected revenue to higher-than-forecast subscription and advertising dollars. In January, NFLX increased prices across the board, raising its standard plan to $17.99 a month, its ad-supported plan to $7.99, and its premium plan to $24.99. Pricing power is a wonderful thing, and video streaming is still cheap entertainment compared to most alternatives. As a digital service, Netflix is another business less exposed to the global tariff war than other mega-caps, a definite advantage in the last few weeks.

Whilst we acknowledge the stock is not “cheap” trading around its average valuation of recent years, we are confident it’s a great franchise with low terminal value risk that offers defensive capabilities as a tech staple. If we get a sharp bounce in US tech over the coming weeks, NFLX would be an ideal place for some of the high-beta monies, affording some relatively conservative quality US tech exposure.

- We like NFLX around $US1040, looking for new highs through 2025. As investors, we should remember there’s nothing wrong with buying strong stocks making fresh highs.