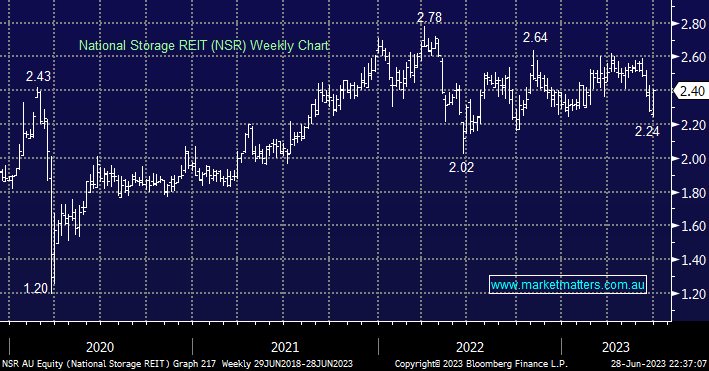

The interest rate-sensitive Real Estate Sector popped over 2% yesterday following the market-friendly inflation print, this is one sector where we want to increase our exposure moving forward, especially if we are correct with our outlook toward 3-year bond yields. NSR has been on our hitlist for a while with the $2.20 level being where we had been considering starting to accumulate a position, in hindsight, we now look too pedantic – note the sock trades ex-dividend 5.5c unfranked this morning.

- We are now considering NSR around $2.30 leaving some room to average if we do ultimately see a dip under $2.20.