We are less than three weeks into 2024, and it’s evident that today’s market is focusing more on the micro/stock news as opposed to the macro, at least for now. The US NASDAQ registered fresh all-time highs overnight, even as Fed members attempt to rein in the market’s optimism with regard to rate cuts in 2024, i.e. a market that rallies on bad news is a strong market. At MM, we have been bullish towards tech for over twelve months, targeting the recent advance by the “magnificent seven.” Hence, it’s important to understand that while we have now migrated to a neutral stance from a risk/reward perspective, further upside looks likely.

- We have been planning to reduce our local tech exposure into strength and this plan remains in play as the sector shrugs off bouncing bond yields.

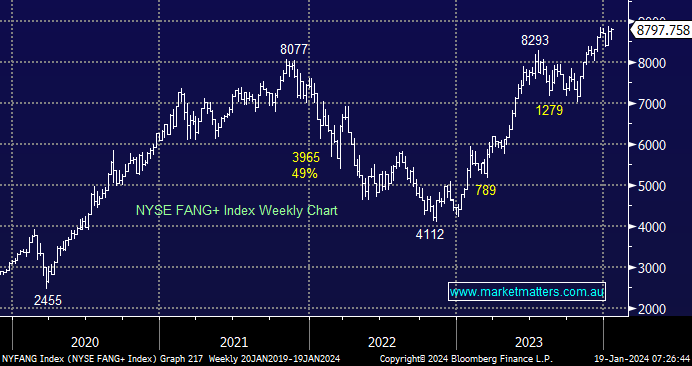

The rally by Apple overnight helped push the NASDAQ to fresh new highs and the FANG+ index within 1% of its similar milestone – further upside looks/feels inevitable short-term. However, as investors, we must remain open-minded and look ahead as opposed to in the rearview mirror, and we believe the risk/reward with regard to US tech is now leaning in favour of selling into strength as opposed to buying dips.

- We believe the US tech advance is maturing fast, and the sector will underperform in 2024, however the FANG+ Index does look poised to make fresh all-time highs in the coming weeks.