This morning, ahead of today’s webinar (Register here if you’d like to attend) we’ve recapped what’s unfolded with the three positions in our Active Growth Portfolio, which are giving us the most angst. It felt like a classic case of “when it rains, it pours” in recent weeks, and we found ourselves with three positions delivering an ugly contribution to our portfolio performance, fortunately, an unfamiliar position. We are now balancing a combination of questions:

- Does our original thesis to own the stock still stack up?

- Are the reasons behind the stock’s decline justified?

- What is the stock’s outlook over the coming 6-12 months?

- If we had no position, would we buy today?

The simple answer we are looking to deliver is whether we should buy more (average), hold or sell, plus, of course, the reasons why.

NB For subscribers who cannot attend today’s webinar, it will be posted on the MM site in the coming days.

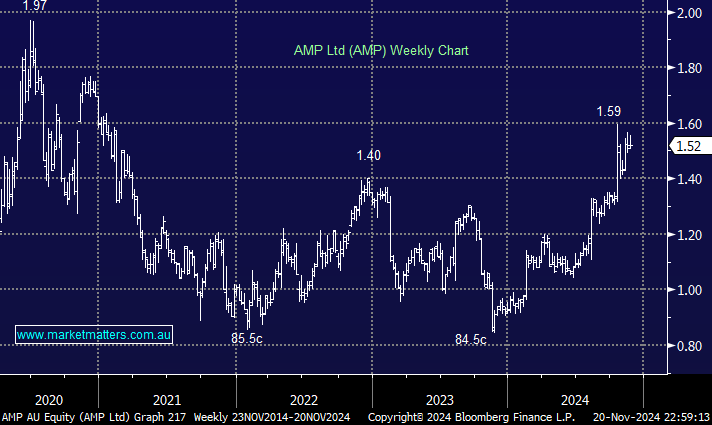

To set the scene, we’ve highlighted AMP below as a great example where markets became way too bearish on a stock and AMP has almost doubled from its recent lows, a company most people would never have considered buying at the start of 2024. Equally, over optimism can be very dangerous, and we’ve often sighted the example of Lithium /ESG names through 2022, with 2024 delivering a dose of reality.

- We must remember to remain open minded about what comes next, and not anchor our thinking to the price we paid for a particular position.

This morning’s 3 stocks won’t surprise investors, but it’s all about what’s next.