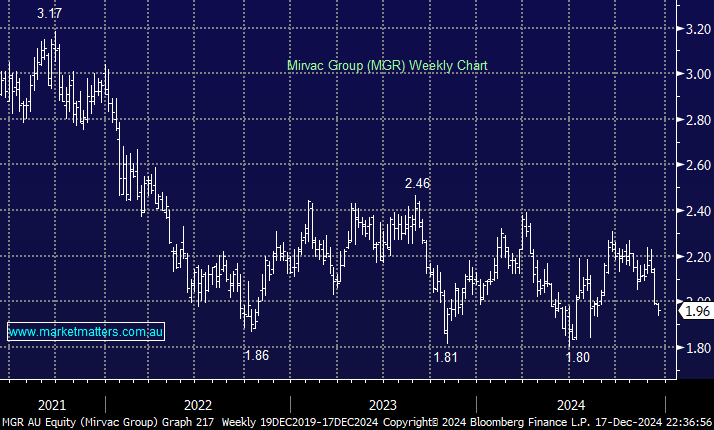

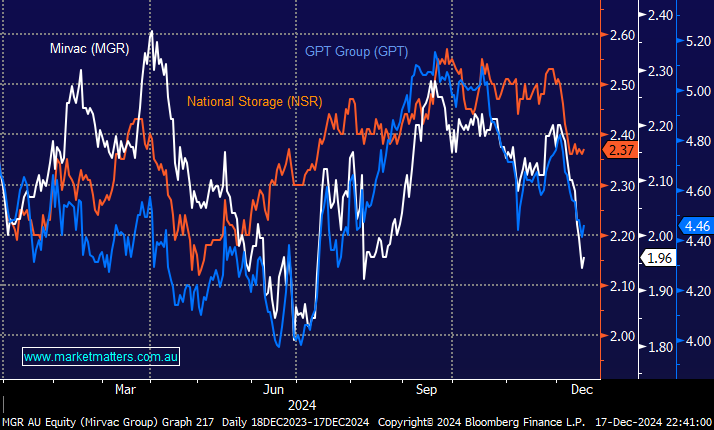

Mirvac, along with the majority of the property sector, has endured a tough month; hence, we consider if it’s a Buy, Hold or Sell at current levels after retreating over 10% this month so far. The stock has been accompanied by the whole sector, with 19 of the 20 companies in the large group falling over the same timeframe, positioning it as the worst performing sector in the ASX200 this month, down 4.8% month-to-date. The chart below illustrates the moves in our portfolio positions in MGR and NSR plus GPT Group (GPT), which we exited in November on concerns that our sector exposure was too high.

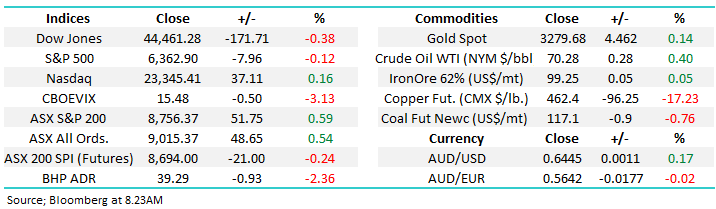

On the surface, last week’s RBA pivot, at least in rhetoric, should have been bullish real estate as it has been for the consumer discretionary (retail) stocks that are the best performers, advancing +1.9% in December. However, the weakness is not all about Australia, with the US real estate names falling over 6% even with the Fed set to cut rates tonight, i.e. there’s more at play than interest rates. The weakness is more straightforward to explain in the US, but as the saying goes, “When the Dow coughs, we get a cold”:

- Investors have reined in their expectations for rate cuts by the Fed through 2025; some rotation back into high growth names has been evident, plus concerns remain around valuations as the office sector continues to grapple with high vacancy rates and changing work patterns, while retail properties are adjusting to shifts in consumer behaviour.

However, the ASX and US share all of the above except for the positions of the respective central banks, with the RBA appearing set to start cutting rates way after the Fed, BOC, and ECB pressed their respective easing buttons.

- We believe the sell-off in the local real estate names is overdone, especially on the relative front across the ASX.

Our bullish view towards MGR is based on expectations for an improved medium-term growth profile as low-margin projects roll-off, Harbourside is launched, and apartment pre-sales recover as interest rate cuts start in 2025. We also see a quality/growth investment portfolio, which is enhanced as lower-quality assets are replaced with development completions. Even without a strong market recovery, we see temporary headwinds subsiding through 2025 as the government tries desperately to deal with the chronic housing shortage weighing on Australia.

- We like MGR moving forward, and its forecasted yield of ~5.4% will allow us to be patient – MM owns MGR in our Active Growth Portfolio.