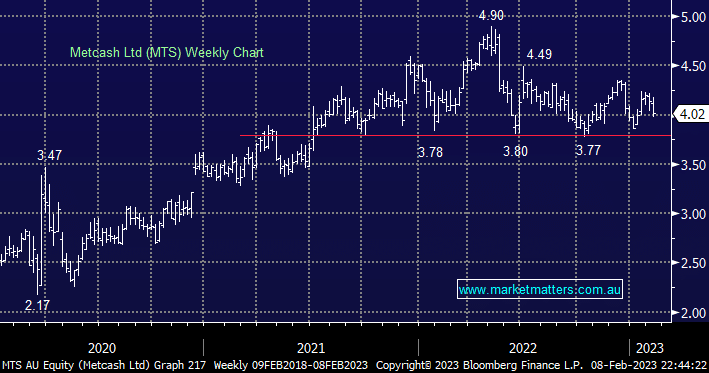

In December we saw the 1H23 results from the grocery wholesaler and growing hardware operative believing they were solid in all key metrics, hence we continue to believe MTS will continue to be a slow burn on the upside with our eventual target remaining at $5.00 which by definition makes the risk/reward appealing under $4.

- We hold MTS in our MM Active Income Portfolio for its forecasted +6% fully franked yield over the next 12 months.