MTS held a well-attended investor day yesterday, which speaks to the increasing interest in the stock. Tuesday was company presentations, putting more meat on the bones of their strategy, while today will be site visits, probably less well attended! We’ve owned MTS in the Income Portfolio since 2020, and we think the business has improved over that time and should be trading on a higher multiple of a growing earnings stream. One of the key reasons we like MTS is that it provides a platform for entrepreneurs. We think the businesses they operate (food & hardware) benefit from having that owner/operator feel about them backed by the scale and capability of a national footprint.

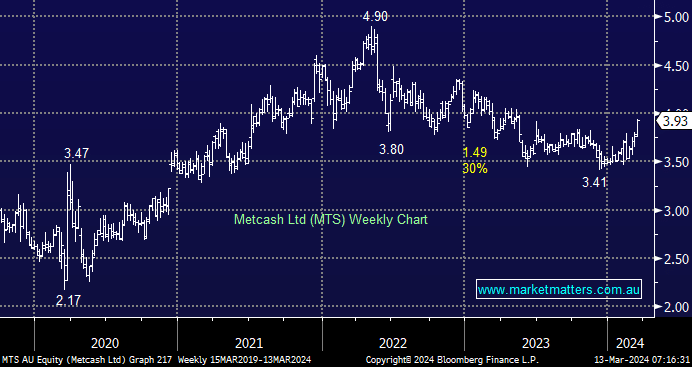

Metcash recently acquired three additional businesses for ~$578m that complement their existing operations and are consistent with their strategy in food and hardware. The purchases were funded by a combination of debt ($278m) & equity ($300m) with shares issued at $3.35 – allocations were scaled back, and it proved a good deal, with the stock now trading at a 17.3% premium. The additional debt does push leverage up to the higher end of their targets in FY25/26; however, by FY27, they are set to be back in the middle of the target range. We now expect a period of less activity on the acquisition side and more focus on integration.

As part of the strategy day, they provided a trading update that was slightly better than expected, with total sales +0.9% for the first 10 months of the financial year. However, what will drive the share price higher will be incremental evidence of strong execution of the larger group, which is how MTS will bridge its big valuation discount to the market and larger peers. If the market gains more confidence in the long-term earnings trajectory for MTS, it will trade on a higher multiple.

- MTS still trades on a 1-year forward PE of 13.1x, a 43% discount to the ASX200 Industrials (ex-Financials), while yielding 5.6% fully franked. Continued execution of their strategy is now the key.