Last Friday, MTS held its 2024 AGM, and although surprises were thin on the ground, a few points caught our attention as FY25 commences:

- Food sales remain resilient, although there has been a modest market share loss to COL & WOW based on the 1st eight weeks.

- MTS’s independent Hardware Group (IHG) remains challenged, with trade activity softening and retail stores facing margin pressure due to lower volumes.

- The liquor division has gained market share to start FY25

The MTS digital transformation project is running three months behind, and capex has been increased by around 4%. This is a win for us in today’s environment, where cost blowouts are way too commonplace.

- We like MTS due to its resilient Food and liquor divisions and growth potential in Hardware when the cycle improves.

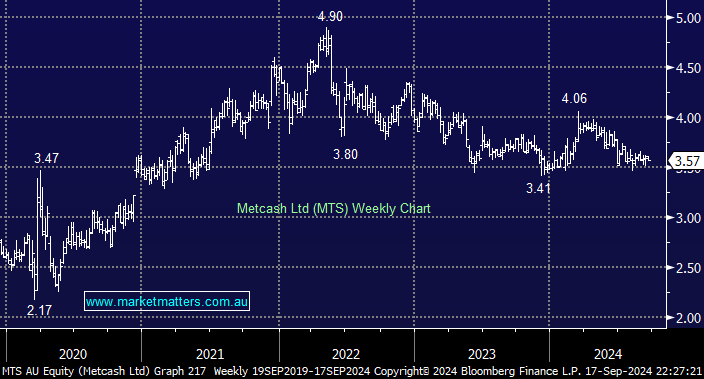

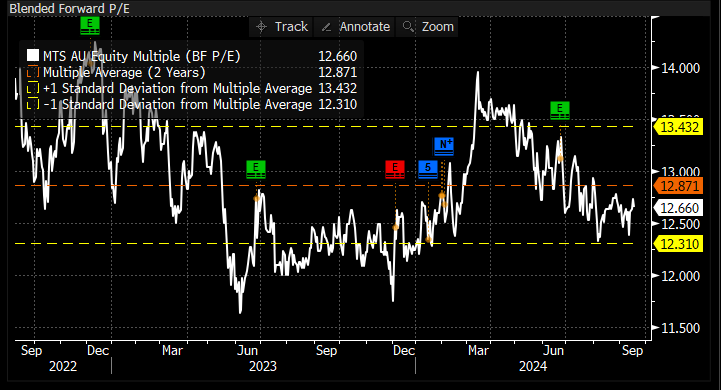

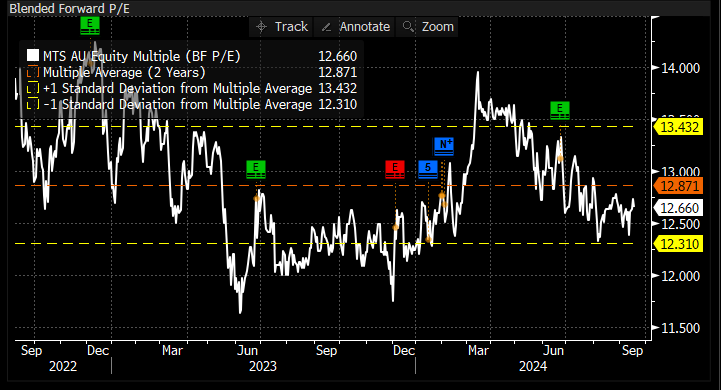

From a relative valuation perspective, MTS is trading 2% below its 5-year average, while larger peers Woolworths (WOW) and Coles (COL) are trading at slight premiums of +1% and +2%, respectively. This is a case of apparent market efficiency, which is not currently delivering compelling risk/reward opportunities.

MTS has resided in our Hitlist for a while as an option for when we want to migrate the portfolio down the risk curve &/or if its price affords us enticing value. The stock is forecast to yield in excess of 6% fully franked over the coming 12-months; hence, with good entry, it’s a solid holding, even for a growth portfolio from a medium-term perspective.

- We can see MTS testing 5-10% lower over the coming months, so we are likely to remain patient with regard to accumulating this consumer staple.