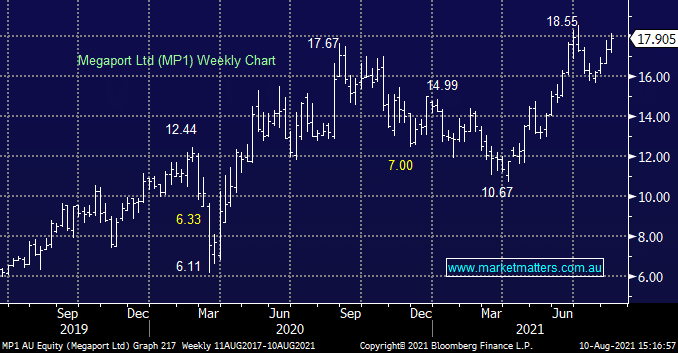

MP1 +3.11%: The Network as a Service (NaaS) provider had pre-reported top-line metrics however the details of the result was positive. Revenue of $78m was largely inline with consensus expectations while an after tax loss of $31.3m was a touch better than expected. The pro’s to the result included MP1 achieving EBITDA breakeven in June 21 as they had been targeting, strong growth in ports added + reoccurring revenue which all bode well for FY22. No guidance was provided. All in all, we like MP1 even though we recently sold out of the stock, more a portfolio decision that a reflection on the business.

scroll

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM is now neutral MP1 around $18 after a solid run

Add To Hit List

Related Q&A

MM’s view on WTC and MP1 please

Does MM like Megaport (MP1) into current weakness?

What are your current thoughts on Megaport (MP1)?

Is MP1 Megaport Ltd (MP1) presenting value?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.