MP1 has almost doubled in 2025 but we shouldn’t lose sight that it was trading well over $20 post-COVID. The company offers a Cloud-based Network-as-a-Service (NaaS) platform, enabling swift, secure connections between businesses and their cloud, data centre, or service provider environments, without relying on public networks. We like the company’s offering in todays rapidly evolving world as it offers a fast, reliable and cheap global service.

This high-growth, volatile local tech stock is now making money, turning previous losses into profits and logging strong growth in both revenue and cash. In the first half of FY25, revenue rose 12% to $107mn. With a strong runway of growth already built into the company’s $2.3bn valuation, we are reticent to chase strength. Megaport is expected to roughly double earnings every two years, meaning profits could climb from tens of millions now to over $200m annually by 2030. Assuming growth unfolds to this level, the stock’s okay value, but there’s plenty of room for disappointment in that time-frame.

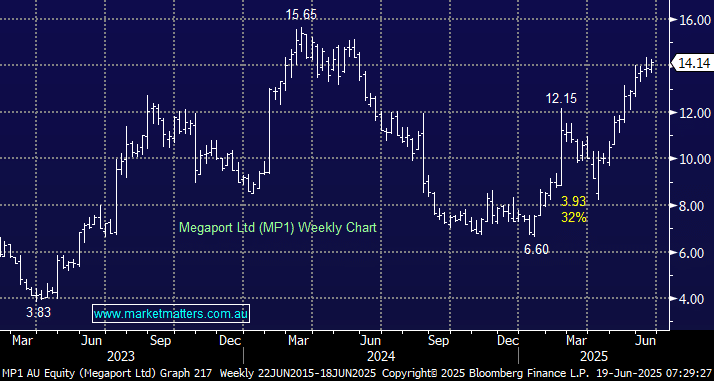

- We think a lot of the positive outlook is baked in around $14, though momentum is strong, and the stock could easily test $15 as the market continues to push winners to extremes