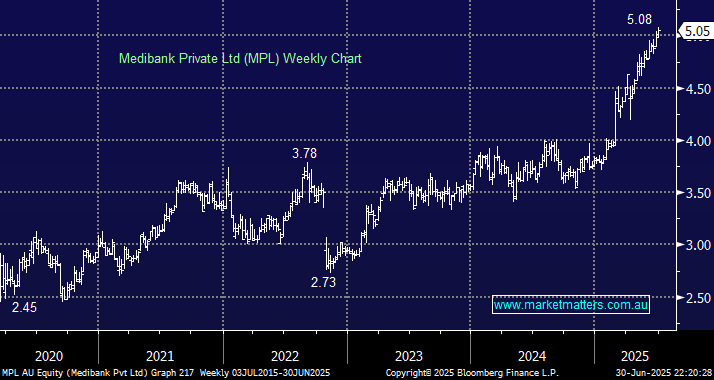

Health insurer MPL hasn’t looked back since it reported better first-half profits driven by impressive margins in its health insurance business in February. The stock has already advanced by well over 30% in 2025. Still, while its projected fully franked yield of around 3.7% should be supportive during rate cuts, the business will lose around $7mn from its investment income with each 0.25% cut by the RBA; hence, it’s hard to get overly excited above $5 especially after the company reaffirmed guidance earlier this month suggesting no positive surprises in the coming months. In 1H of FY25, MPL reported a 13.8% increase in underlying NPAT to $298.7 million, with underlying earnings per share also rising by 13.8% – a stock enjoying its position in the “Certainty Trade” basket.

- We like the risk/reward towards MPL back around $4.80.