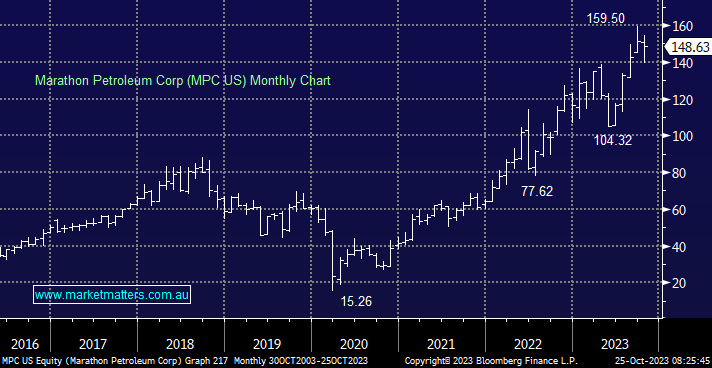

We turned our attention to Marathon Petroleum (MPC US) this morning because it has a similar market cap to Hess Corporation (HES US) that Chevron has just moved on, i.e. HES ~$US48bn and MCP ~$US59bn. MCP has been a major outperformer post-COVID, advancing 10x compared to Exxon and Chevron, which have advanced around 3x. However, as MPC is set to report its latest quarter earnings, previous performance might weigh on what follows.

- The refiner is expected to post quarterly earnings of $7.48 per share in its upcoming report, which represents a year-over-year change of -4.2%. Revenues are expected to be $35.26 billion, down 25.4% from the same quarter last year.

MPC has rallied an additional 16% in the recent quarter, increasing the room for disappointment from its latest numbers. The company’s transition to profitability is already reflected in the positive shift in market perception, which is evidenced by the relationship between earnings per share (EPS) and share price, but again, the good news looks factored into the share price.

- We like MPC into a correction, but it’s feeling “rich” on the upside following a strong few years.