MAQ jumped 9.6% on Monday after announcing a $240 million land purchase for a new Sydney data centre campus, which will deliver over 150 megawatts of capacity to support AI, cloud, and government workloads. The strong share price reaction stood out, as other companies expanding in the data centre space this year have struggled due to capital raisings and potential execution risk. In contrast, investors welcomed MAQ’s move, seeing it as a strategic step that reinforces its position in the rapidly growing data infrastructure sector. Importantly, the acquisition will be funded using existing cash reserves and drawdowns from its recently upsized $450 million revolving debt facility.

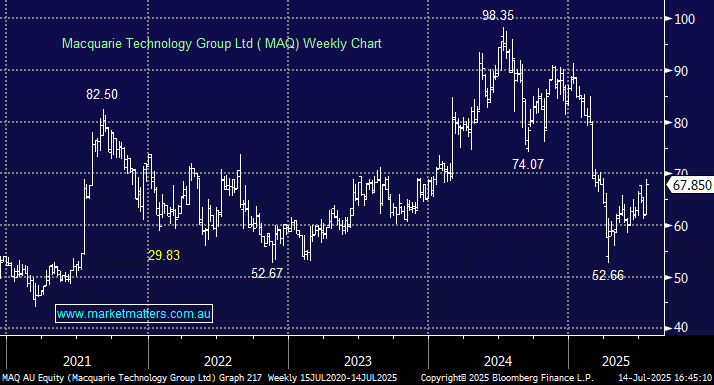

We discussed MAQ in detail in May, with one stand-out comment being, “The big question with the share price is what price to pay for potential Data Centre growth, which carries with it execution risk on DC development plans.” Yesterday, we got some clarity here, and the market’s reaction tells the tale. It’s not currently our favourite pick in the space, although we do like it, and like the market, and regard Monday’s news as a posiitve.

- We aren’t excited by the risk/reward towards MAQ around $70, but we are watching it carefully, being fans of DC’s in the years ahead.