MAQ is a new entrant to the ASX200, having been added in early March, a $1.6bn Sydney-based telco service provider of cloud and IT services, serving an enterprise and government customer base across Australia. It is strategically positioned across the growing categories of cloud infrastructure and managed services, backed by its portfolio of data centre assets, including its flagship 63MW campus in Macquarie Park, Sydney. Plenty of “in fashion” buzzwords around the business, but like many tech stocks, MAQ has struggled over the last 10 months. The company’s revenue is generated from three primary areas:

- Cloud Services & Government: Running at 56% of revenue, having decreased by 2% in 1H25. A short-term revenue challenges in our view.

- Voice and mobile Telecommunications: At 31% of revenue, they decreased by 3% in 1H25 due to NBN business broadband pricing pressure. We expect this trend to continue and weigh on margins.

- Data Centres (DC): They account for 13% of revenue and increased by 20% in 1H25. MAQ is committed to its significant DC development pipeline, and demand remains robust.

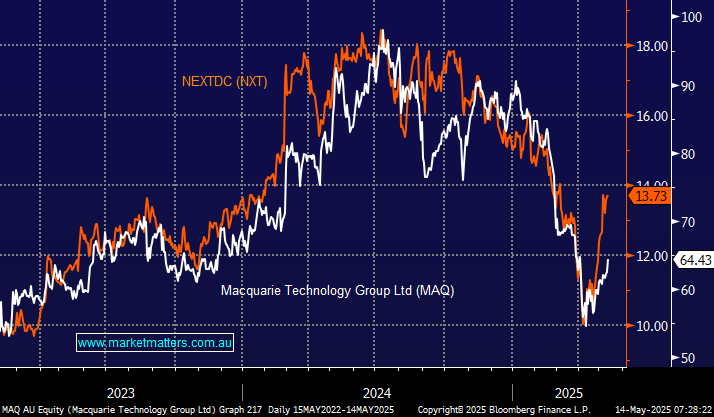

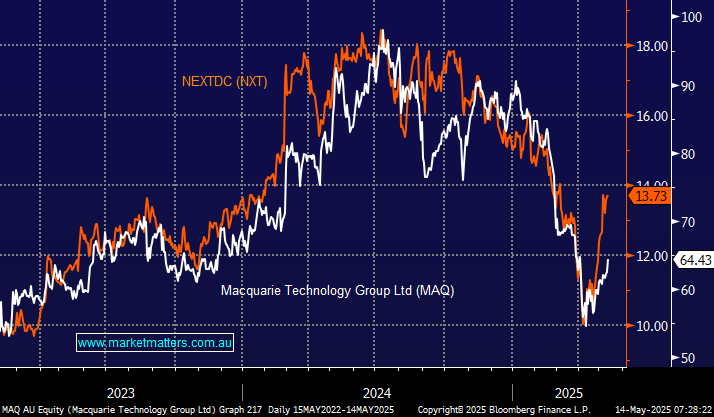

Not surprisingly, on a quick look, MAQ is being priced as a DC stock, because this is where the earnings growth is expected in the years ahead.

MAQ reported its tenth consecutive year of earnings growth in FY24, with revenue increasing by 5.3% to $363.3 million and EBITDA rising by 5.8% to $109.1 million. Still, the company’s share price fell by over 5% on the day due to elevated expectations, and it’s been a similar story over the last three quarters as the stock has tracked its volatile DC peers. Companies whose growth is tied to Data Centres & AI have been on a roller coaster ride regarding valuations/risk the market has attributed to them and especially since the news around DeepSeek, which triggered a $US 1 trillion sell-off in equities, illustrating that the AI journey will likely experience many twists in the road.

- MM currently prefers Goodman Group (GMG) for our Data Centre (DC) exposure: MM holds GMG in its Active Growth Portfolio.

MAQ has a strong track record of managing its portfolio of businesses to achieve consistent profit growth. The big question with the share price is what price to pay for potential Data Centre growth, which carries with it execution risk on DC development plans. The stock is trading on an estimated 46x for FY25, which, like much of the space, is attractive compared to recent years. However, the stocks already bounced ~20%, and while we are net bullish, the risk/reward isn’t compelling at current levels.

- We like MAQ as a business and its growth focus, but it’s not our preferred DC play.