The world has been awash with effectively “free money” over recent years fuelling the almost incomprehensible appreciation of assets from collectable cars to art, property and of course stocks – we’ve all heard the stories of crazy prices being paid for items that some of us would almost regard as trash, perhaps crypto currencies will ultimately follow the path of tulips back in the 1630’s.

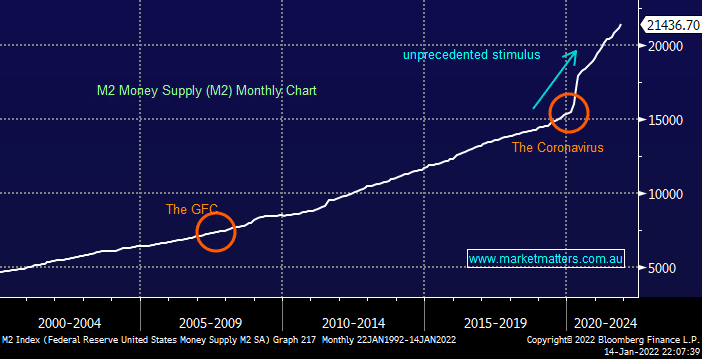

The Fed’s M2 Money Supply basically measures the total volume of money held by the public at any particular point in time and more cash in circulation equals more spending and asset price appreciation, the acceleration over the last few years is clear to see.