Lundin has a portfolio of long-life assets in Chile, Brazil, USA, and Portugal which is very aligned with BHP’s South American copper strategy with several assets near BHP’s existing footprint. It has a manageable market cap, about a 3rd of AAL but its revenue is dominated by copper, which could appeal to BHP. The big issue is valuation with the stock already trading ~60% above its 5-year average making it hard to see how BHP could add value after being forced to further pay a takeover premium.

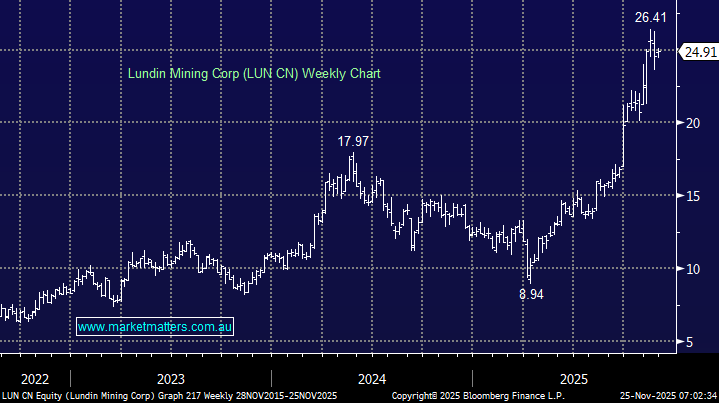

- We can see BHP scanning the ruler across LUN, although it has run harder than many in the copper space.