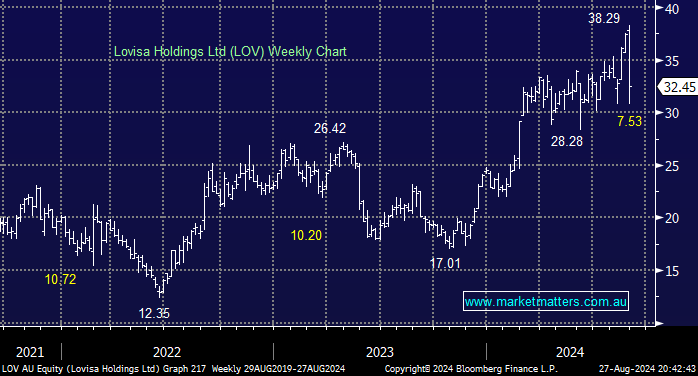

LOV’s business model is simple and effective. Lovisa sells cheap earrings, necklaces, bracelets, and other jewellery at over 80% gross profit margin. However, LOV was smacked -13% on Tuesday after reporting slightly softer than expected FY24 revenue plus a weaker trading update to start FY25, not ideal for a stock that had surged over +50% through 2024, making a fresh all-time high the day before the result. While their FY24 result was solid on most metrics, small misses are amplified by high valuations, and the first 8-weeks of FY25 is also tracking on the softer side.

- Revenue increased by +17.1% yoy to $699 million, a 2% miss on expectations.

- Gross Profit of $565.8m, up +18.7% yoy, a 1% miss to expectations.

- NPAT was up +20.9% compared to FY24 and finished at $82.4 million, in-line.

- LOV declared a final dividend of 37 cents per share, taking their FY24 dividend to 87c, ahead of the market expectations of 76.1c.

For retailers, how they’re tracking in the first couple of months of the new year is important. We’ve seen the likes of JBH and SUL report solid progress, however, LOV only recorded same store sales growth of +2%, and while new store roll-outs pump up overall growth, as we’ve highlighted in the past, we think there is some risk around the trajectory of the roll out under a new CEO.

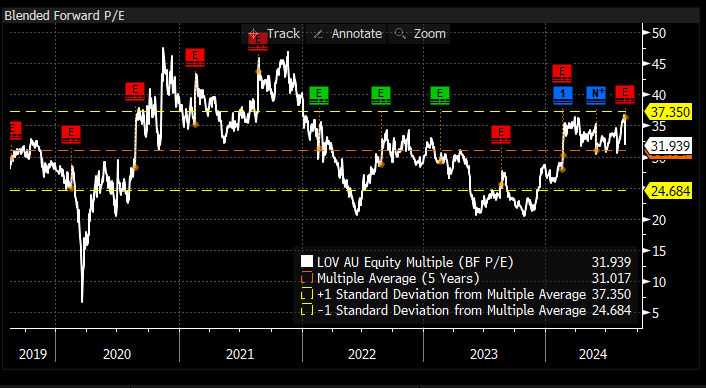

- We like LOV as a business, the big issue is just price/valuation, and even after yesterday’s sharp correction, the share price has only fallen back to the average valuation of the last 5 years.

The attractive long-term growth outlook is well reflected in the still elevated earnings multiple, making the risk/reward unattractive ~$32. In the medium term, we are confident that the younger core customer and low price point offer will make LOV well-placed in a challenged global consumer environment but each year will likely be harder to maintain growth. We were told yesterday to assume store openings in the 12 months to June 30 would be somewhere between last year’s 128 and the year before ‘s 210, a whopping difference.

A quick visit to the MM site illustrates how popular LOV had become, with 1 Sell, 10 Hold, 4 Buys, and 1 Strong Buy. However, as management leaves analysts almost second-guessing what comes next, we’re surprised they’re not a touch more guarded. For example, FY26 earnings per share forecasts range from $1.01 to $1.41, a huge differential. While we do find the management style a touch refreshing, we want a relative discount in valuation to consider the retailer.

- When we reflected on LOV’s call, it reminded us of Frank Sinatra’s “I did it my way”, as they certainly didn’t pander to analysts.