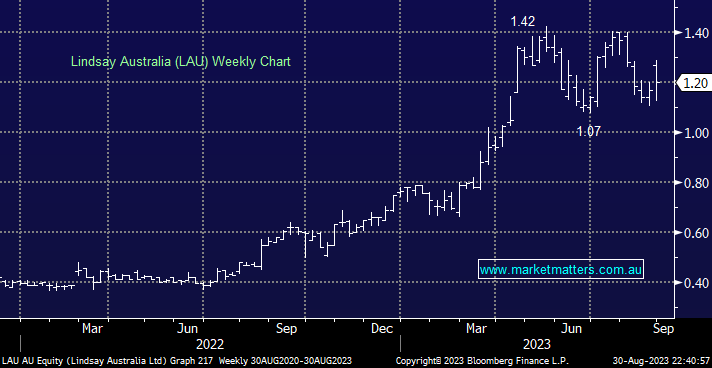

This is an interesting company with a market capitalisation of $372m involved in integrated transport and rural supplies. We previously flagged LAU as a candidate for our Emerging Companies Portfolio and that view hasn’t changed post their recent FY23 results.

LAU delivered record revenue ($676m), underlying EBITDA ($90m) and NPAT ($36.5m) in FY23 as they progressed with what looks to be a very disciplined growth strategy – they are now the largest refrigerated transport company in Australia. They announced a 2H fully franked dividend of 3cps, bringing the FY dividend to 4.9cps, up ~50% on FY22. Without providing specific guidance, they said strong momentum from FY23 has continued into early FY24.

We expect LAU to focus now on operating efficiencies, reducing core business costs, however, we would not be surprised to see further bolt-on acquisitions.

- We continue to like LAU whose revenue is forecast to grow +11% pa on average over the next 3 years – MM has LAU in its Emerging Companies Hitlist.