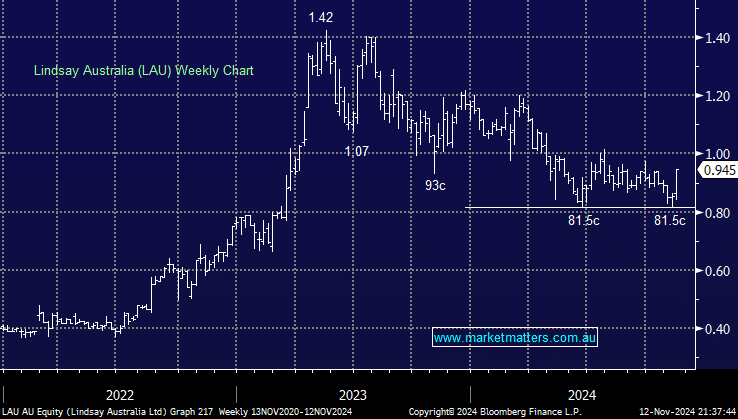

LAU is a ~$300m integrated transport, logistics, and rural supply company with an emphasis on food, including processing, services, fresh produce, agriculture and horticulture industries. FY24 was a challenging year, and while the value of food retail sales in Australia were up 2.8% in dollar terms, the volume of food sales declined 0.9%. Overlay that with inflationary pressures on the cost side, and it’s understandable the stock drifted back from $1.40 down under $1.

- We flag LAU today as a defensive logistics business, exposed to a defensive area of the market (food) that has found a good level of support in the last few months.

A recent report by CBA showed that housing costs had the greatest impact on the cost of living in FY24 (contributing 25% to CPI growth) followed by food (contributing 19% to CPI growth). As the RBA eventually cuts rates (our call is 1 cut this FY and more to follow), in part driven by lower inflation, this should underpin an uplift in retail sales volumes, including food.

Management are seeing this trend tentatively start to play out; commentary at their AGM was that the first four months of FY25 trading, grocery and commercial volumes are up 5%. Higher volumes drive higher earnings, and with the shares trading on an Est PE of 8x, yielding over 6% fully franked, LAU is a more defensive candidate for the Emerging Companies Portfolio, albeit on the smaller side.