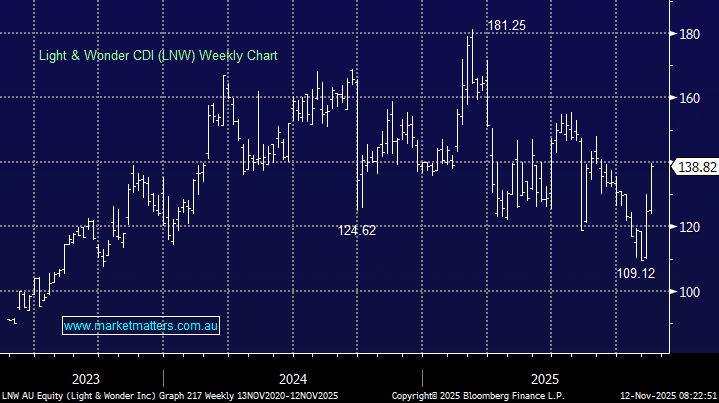

LNW shares have rallied strongly this week, up 11% to a two-month high, though they remain over 20% below the year’s peak. Underpinning the move was a better-than-expected 3Q25 result, the extension of its ASX share buyback, and news that US investment firm Fine Capital Partners had taken a 10.1% stake in the company.

The September quarter was solid;

- 3Q underlying earnings (Ebitda) was up +18% YoY, +4% ahead of consensus.

- Adjusted net profit rose +11% boosted by lower tax and finance costs.

- iGaming was the big driver, up +21%, while broader gaming earnings were around 5% ahead of expectations.

Trading before this week had been soft due to slower than expected growth, meeting a bullish market towards the end of last year. That combined to see a big re-rate lower in the share price over the last 8 months, however, we now question whether the improvement in Q3 is sustainable, and LNW is on a better footing to reaccelerate growth in FY26 (they are a December yearend).

While the magnitude of the quarterly beat was in part driven by lower R&D spend, and a better tax and financing outcome, sales growth also picked up, which is what really matters. Installs of new machines were higher than hoped, as were overall sales volumes executed at better prices, with the global average selling price up +15% YoY, with 6,000 outright sales exceeding forecasts. That drove a big beat on margins, but some of that we would put down to temporary cost relief rather than sustainable improvement.

In short, the quality of earnings was decent, but not flawless; cost discipline helped, but some of those savings will likely reverse in FY26. The Gaming division continues to drive growth via higher premium leased content and expanding unit installs, and iGaming remains a key structural tailwind, reflecting global online momentum.

The announcement of a 10.1% stake by Fine Capital Partners also highlights growing institutional interest following weakness in the share price. The company is still progressing its Nasdaq de-listing (Nov 13) and transition to a full ASX listing, alongside an expanded buyback program, and Jefferies rightly pointed out that the buyback is “materially accretive at current levels”.

Following the quarterly update, UBS maintained a Buy rating with a 12-month price target of $206/share. They have been bullish on the stock for a while (and wrong), however, more broadly, 14 of 17 analysts covering the stock rate it as a buy, with a consensus price target of $172.58 (with 3 holds).

- We’ve had LNW on the Hitlist for a while now, and patience had paid off, until this week. We like the trends around improving installs, better pricing power, and a stronger iGaming trajectory, but some of the recent beat reflects temporary cost control rather than pure operational leverage. That said, we are getting closer adding LNW to the Emerging Companies Portfolio.