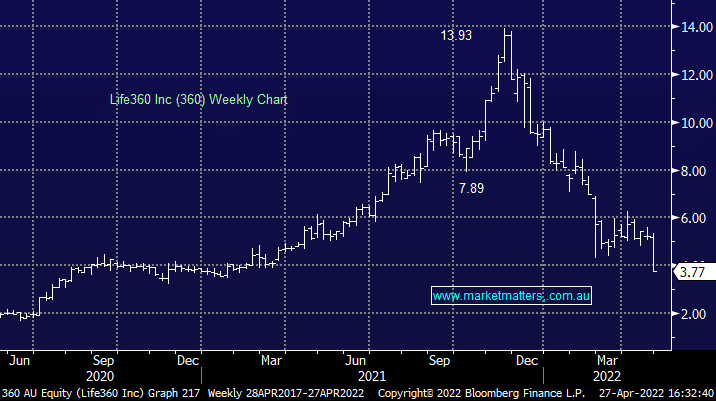

360 -29.4%: family tracking and safety business Life360 saw shares fall to a 2 year low today after halting plans for a dual listing in the US and providing soft guidance for the full year. Growth is coming through the business, though Monthly Active Users were only up 8% in the quarter. Supply chain issues were weighing on their hardware sales so the company is shifting strategy to focus on software upsells. Initial testing has been fruitful, but this is expected to have a slight drag on near term revenue though they expect CY22 revenue in the range of $US245-275m while consensus sits near the top end. The CEO said the US listing plans were dropped following a change in market conditions i.e. the ridiculous revenue multiples are no longer being paid!

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

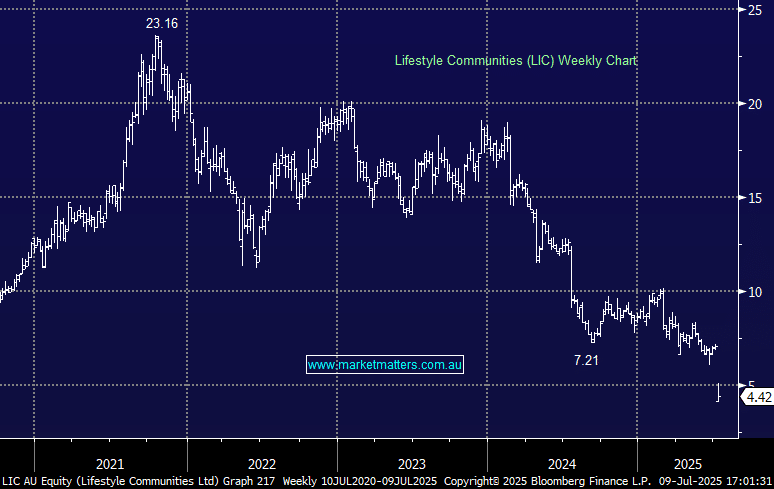

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

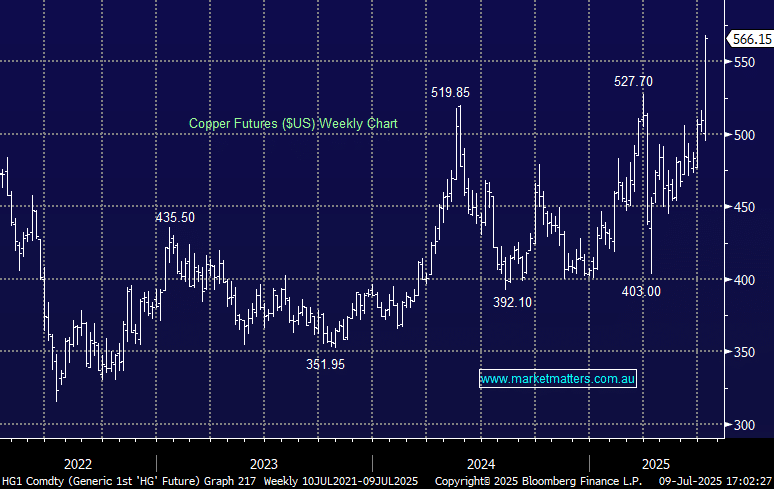

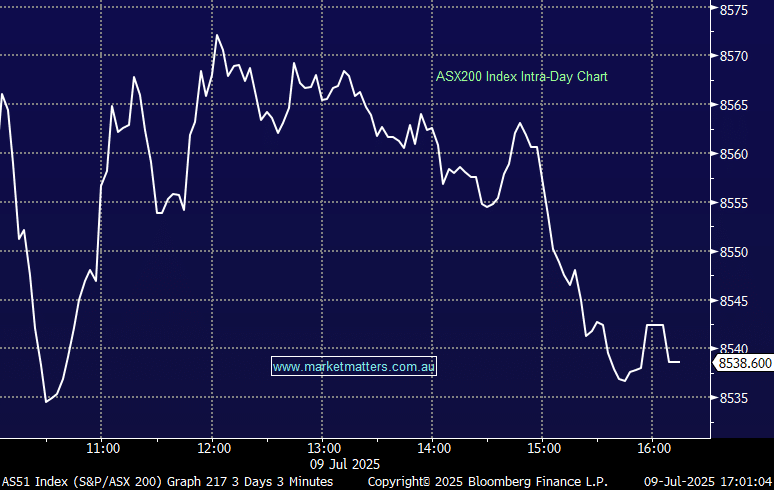

Wednesday 9th July – Dow off -165pts, SPI down -7pts

Wednesday 9th July – Dow off -165pts, SPI down -7pts

Close

Close

MM has no interest in 360

Add To Hit List

Related Q&A

US stocks listed in the US

PMV and 360

Thoughts on Life360 (360) please

Hold, or cut Life 360?

Thoughts on Life360 (360) and ZIP Co Ltd (ZIP) please

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 9th July – Dow off -165pts, SPI down -7pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.