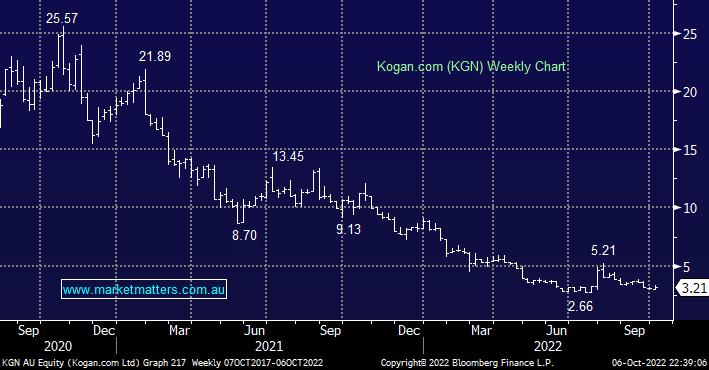

Another picture that tells a thousand tales is that of KGN which has been smashed post-COVID for a number of factors, the main one being management’s decision to extrapolate COVID demand out forever, prompting big increases in inventory. As demand tapered off as more normal trends re-emerged, the inventory was a real headache, and this led to discounting, higher costs for storage, weaker margins and painful earnings downgrades – basically just a typical ‘cluster’ that was to a large degree self-inflicted.

- While we think e-commerce stocks now look interesting, and a combination of Temple & Webster (TPW), Kogan (KGN) and Adore Beauty (ABY) could be a way to play the sector, the picture over the past 2 years is a clear one – when stocks start to miss earnings & / or deliver questionable performance get out – we can always buy back in at higher levels, investing is about optimising returns, not ego.