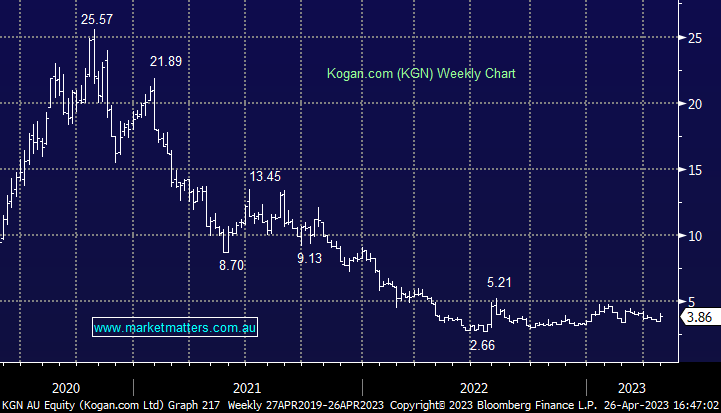

KGN +7.22%: a strong move higher for the e-commerce business on a reasonable 3Q update which came with a surprise buyback. Adjusted EBITDA for the quarter was $4.4m, which compared to a $4.4m loss in the first half, benefitting from an improved inventory position. Inventory has now fallen to $78.3m, around 20% down from the end of 2022. Despite sales falling 28% yoy, gross margins improved as Variable & Marketing costs fell from 10% to 8.1% of total sales. The main kicker was the buyback which aims to purchase 10% of shares on issue which comes despite the company noting a softer outlook of reduced consumer demand and a cash balance of $49.1m which was down in the quarter.

scroll

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral/negative KGN

Add To Hit List

Related Q&A

What stocks would we top up here?

MM views on Qantas (QAN) & Kogan (KGN)

Our view on 3 online retailers

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.