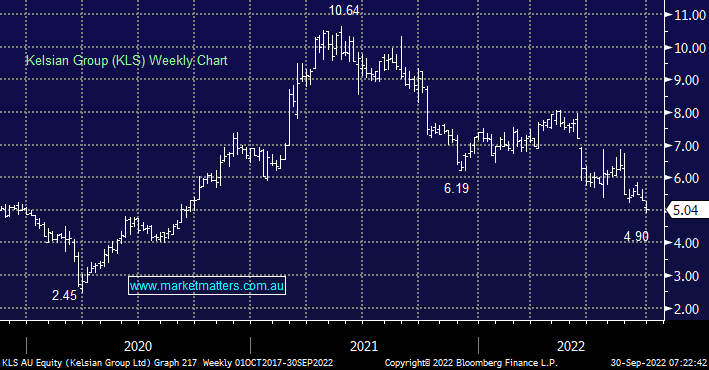

Tourism and transport company KLS is a business with two distinct arms i.e. transporting commuters & freight around holiday destinations plus a tourism packaging business. The company is thought by many to have distinct M&A potential however even while the world throws itself into post-Covid travel/holiday mode the stock hasn’t blinked and keeps slipping lower. The company’s revenue has proved reasonably defensive over recent times although costs are rising with labour shortages a major concern. Trading on a P/E of under 16x for 2023 with expected growth in earnings of mid-single digits, we are at best neutral KLS.

- We see no reason to catch this particular falling knife with a recession looming.