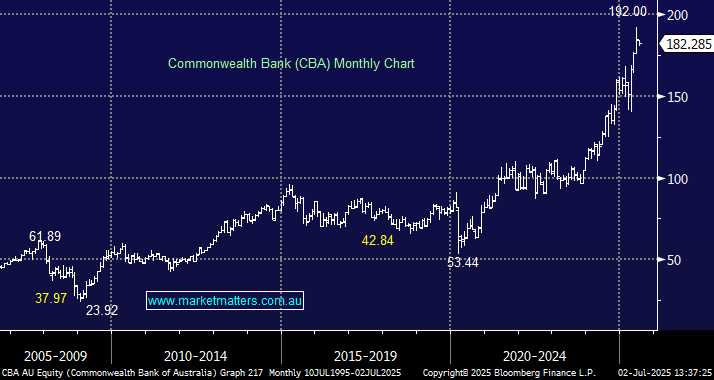

KAR fell another 2.1% on Monday, extending its decline year-to-date to 19.2%. This month saw Morgans upgrade its target for KAR to a whopping $2.80 due to its positive outlook for oil. KAR has significant cash and is fully funded, plus production is set to double over the next 12 months. As subscribers can see on the MM site, analysts like KAR with 3 HOLDS & 10 BUYS, the opposite to CBA, which keeps advancing while KAR slips ever lower, i.e. a great illustration that independent thinking is important.

- We like the risk/reward towards KAR around $1.50, a realistic target as the EOFY approaches.