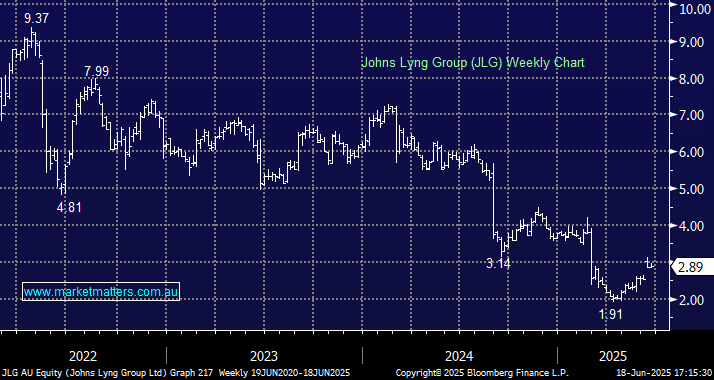

This month, Australian Pacific Equity Partners (PEP) made a $857.8 million takeover bid for Johns Lyng Group (JLG), offering a 19.3% premium over its share price before the announcement. PEP has secured exclusive due diligence access until July 11, with a binding offer expected thereafter, likely in the same $2.90-$3 region. JLG has been out of favour following a couple of significant earnings misses, including a hefty miss and subsequent downgrade in February, leaving investors like us licking our wounds. This is a cyclical business where work/earnings are linked heavily to weather related events, which have been benign. We can see why private equity has interest at this point in the cycle, though we think $3.50 would be a more realistic level.

- We are neutral towards JLG ~$3: MM owns JLG in its Emerging Companies Portfolio.