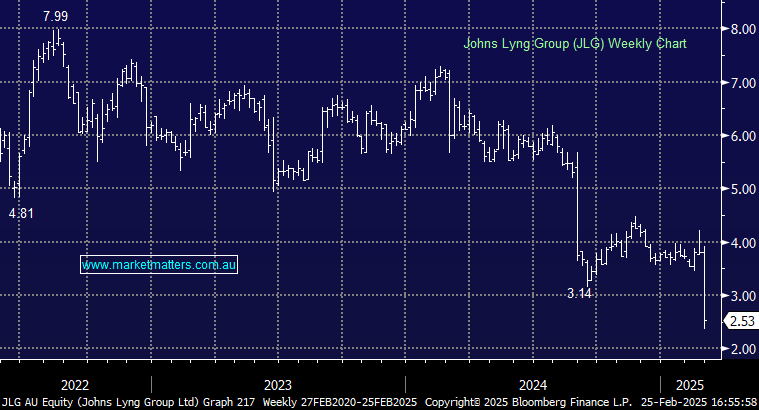

JLG -33.42%: Hit hard today on a weaker result and downgraded FY25 guidance. The stock originally opened down around 20% then progressively got worse throughout the day, despite the call with management trying to allay some market concerns and paint a better picture for the 2H .

- 1H25 Sales revenue of $573.1 million was down -6.1% y/y and below consensus of $607 million

- Underlying earnings (Ebitda) $54.2 million down -15% y/y

- Net profit of $14.5 million was down -38% y/y

- Interim dividend per share A$0.025

They talked to near term challenges due to benign weather conditions across Australia resulting in a reduced volume of insurance claims and CAT-related work, while in the US, project commencement delays also impacted performance. As a consequence, they downgraded FY25 guidance, now forecasting revenue of $1.17 billion relative to expectations of $1.25 billion and earnings (Ebitda) of $126.5 million which is ~14% below consensus. The recut guidance also implies a decent improvement in the 2H to get there, underpinned by yet-to-be-quantified weather events in NSW and QLD.

- This brings with it risk that the FY25 guidance is far from assured, hence the aggressive sell-off today.