The China-based online marketplace reported its second-quarter results on Thursday, beating at the revenue line and showing solid growth, though margins remain a challenge—impacting overall earnings.

- Net revenue: 356.66 billion yuan, +22% y/y, ahead of 335.45 billion yuan expected

- Adjusted EBITDA: 3 billion yuan, -78% y/y, but ahead of the 2.88 billion yuan expected

- Fulfillment expense: 22.1 billion yuan, +28% y/y, vs. 21.05 billion yuan expected

The third point above is the standout, highlighting the rising costs of actually delivering services—particularly in their relatively new large-scale food-delivery business, where they are competing aggressively on price to build scale. Overall, JD reported net margins of 2.1%, which were better than feared, but a business of this type should be producing higher profits. Growth and earnings in their retail division were particularly strong and were the main driver of the beat; however, the key for JD remains its ability to lift margins overall, with a near-term target of 5% as our yardstick.

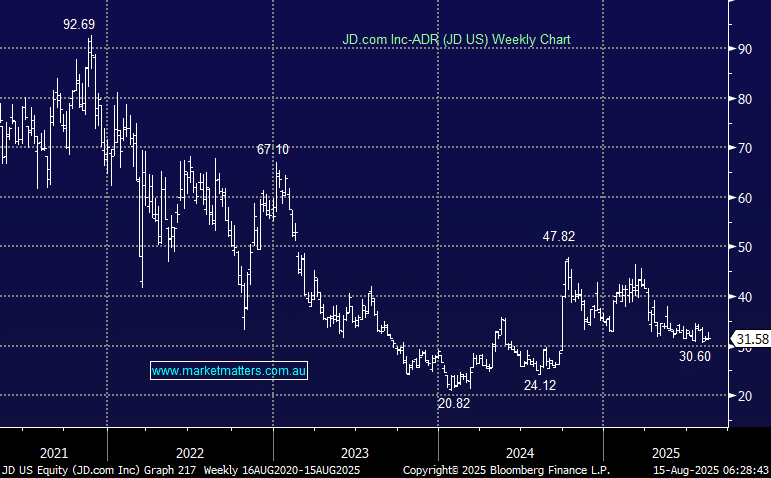

This is the main reason JD trades on just 9.4x earnings, despite showing strong sales momentum. If they can improve margins while maintaining current growth, there is significant scope for a multiple re-rating, which would amplify any share price performance.