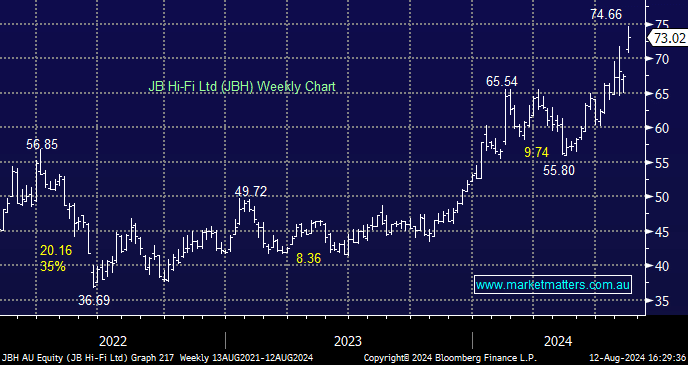

JBH +8.33%: A good result compared to low expectations saw them rally nicely to new highs today, while everyone likes a surprise special dividend;

- Sales $9.59 billion, estimate $9.52 billion / 0.7% beat

- NPAT $438.8 million, estimate $421.8 million / 4% beat

- Ebit $647.2 million, estimate $626.4 million / 3.3% beat

- Dividend of $1.03 + a Special Dividend of 80cps – both fully franked

Our thesis on JBH was around expectations from the market being too low/bearish, and that’s proven on point today. The result was very clean, they’re doing a very good job on costs which is helping to support margins. As we wrote recently, one of the pillars in our investment philosophy is that stock prices ultimately follow earnings over time and that earnings revisions are an important determinant of share prices. This result and a more positive trading update for FY25 to date, should underpin consensus upgrades, which is being priced into the shares today.