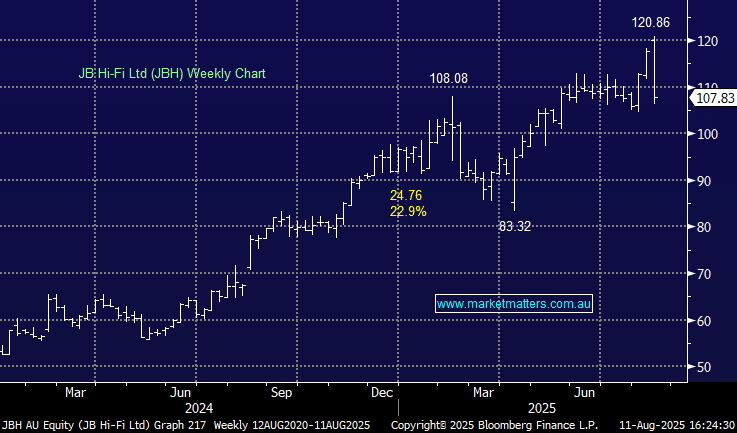

JBH –8.39% delivered a solid FY25 result with earnings coming in ahead of expectations, though a management change spooked the market which was well-positioned for a beat, so simply meeting expectations wasn’t enough with the stock selling off as much as ~10% through the session.

- Normalised EBIT of $708 million, a beat to consensus of $701 million.

- July trading remains strong, with JB Australia like-for-like sales up +5.1% (vs consensus FY26E +4.9%) and The Good Guys +3.8%.

- Final dividend of $1.05 and a special dividend of $1.00 per share, alongside a higher payout ratio of 70–80% (from 65%).

A good overall result with strong LFL sales pointing to resilient consumer demand and the core business remaining robust, though clearly the market has questions around the announced management transition from CEO Terry Smart to COO Nick Wells who steps into the role October 3.