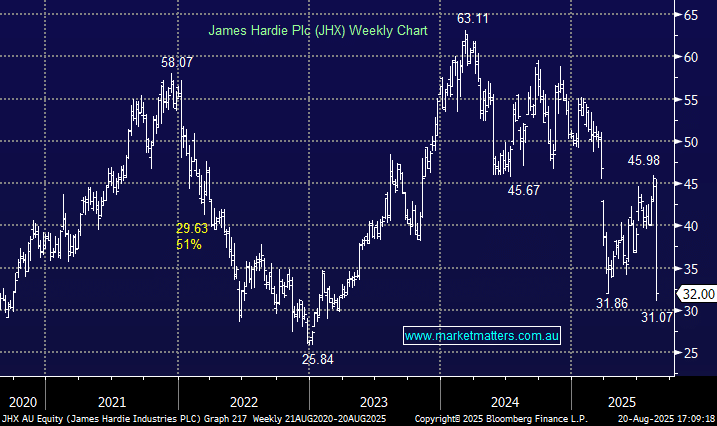

JHX -27.83%: Had its biggest drop in five years, following a significant 1Q miss and a ~24% downgrade to FY26 EBITDA— not a great outcome following closely on the heels of their $US8.75 billion purchase of AZEK. Investors were worried that JHX overpaid for a business facing a slowing market and margin pressures, increasing the risk to returns.

- Revenue of $US900 million was down 9% y/y and below $US935.17 million estimated.

- EPS of 29c was down from 41c y/y and below 31c estimate.

- NPAT came in at $127mn, 19% below forecasts, driven by weakness in the US.

It’s likely to take a long time for investors to regain confidence in JHX after being kicked twice in 2025. However, we note that FY26 guidance appears conservative, assuming cautious channel inventory and macro headwinds, even though recent sell-through trends remain solid.