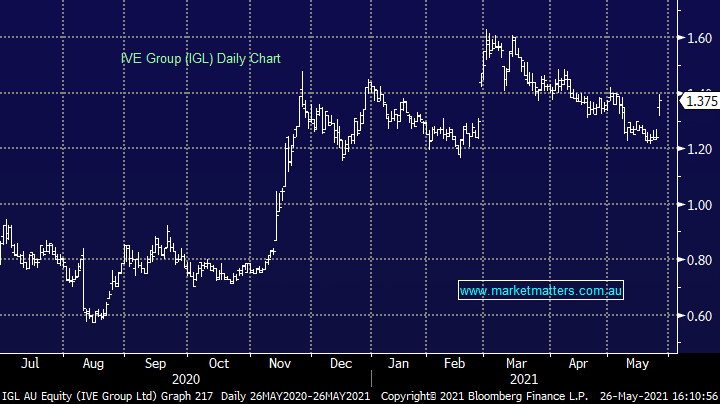

IGL +10.89%: The integrated marketing business, which we own in the Income and Emerging Companies portfolios, Ive Group popped to a two-week high today. The company spoke to strong momentum through the second half after seeing a rebound in sales in the first half. They also discussed 2 new deals – a 5 year deal with Australian Community Media (ACM) and a letterbox deal with Spotlight – as well it’s “strong track record of revenue retention” continuing. They guided to full year underlying EBITDA to $98-100m, inline with FY20 and slightly ahead of market expectations, while debt levels remain manageable. IGL remains cheap, growing top line with PE below 10 and yield around 8%.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

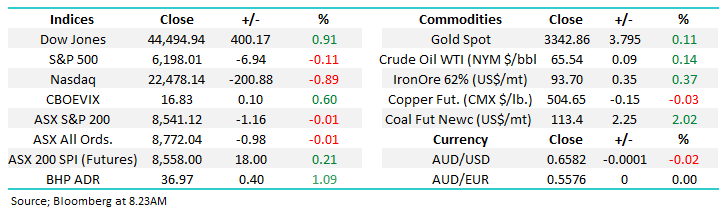

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Close

Close

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Close

Close

MM is bullish IGL

Add To Hit List

Related Q&A

Possible interesting moves in the IVE Group (IGL) share registry??

IVE Group Limited (IGL)

How much of a challenge is AI to IVE Group?

Two IGL directors selling large parcels of shares – any cause for concern?

Why is IVE Group (IGL) getting smashed?

Is the sell-off in IVE Group (IGL) overdone?

IVE Group (IGL) – is it time to sell?

What are MM’s thoughts on the surge in IGL’s share price?

What are thoughts on Calix, IGL, SIQ and SUL?

Thoughts on IGL Share Purchase Plan & the new norm for markets

IVE Group (IGL)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.