This is a diversified ETF that has a broad cross section of holdings including investment-grade fixed-income securities issued by the Australian Treasury, Australian semi-government entities (States and others), supranational and sovereign entities and corporate entities. Basically, it’s a broad portfolio of high-quality bonds mostly issued by government, or agencies that have some sort of implied or actual government backing, blended with a few corporates. As a guide, 47% of the portfolio is Australian Commonwealth debt & 32% in State Governments.

- Advantage: Low cost (0.1%) diversified exposure to Australian investment-grade securities, primarily Govt debt, distributions are paid quarterly, and the last 12 months has seen a 7% return.

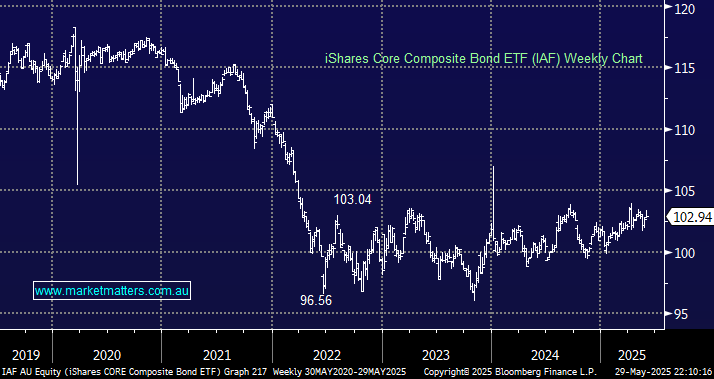

- Disadvantage: This is a fixed rate exposure, so if rates rise, this security will fall. Over the past 5-years, the return is -0.3% per annum (given interest rates have risen during that time frame.

We like the IAF for low-risk bond exposure, that will benefit in a falling interest rate environment: We hold the IAF in the Core ETF Portfolio.