From a market cap perspective, $124bn CSL dominates the healthcare space, whereas the next largest player is Sigma Healthcare (SIG) at $32bn; hence, if CSL struggles, the sector can look poor. However, as CSL reversed lower in a strong market on Wednesday, we saw buying coming into the likes of Cochlear (COH), making us wonder if fund managers are finally reweighting out of CSL. The blood plasma giant has traded sideways over recent years while global equities have powered higher; after ~10 months, our position is down more than 6%; patience can only go so far.

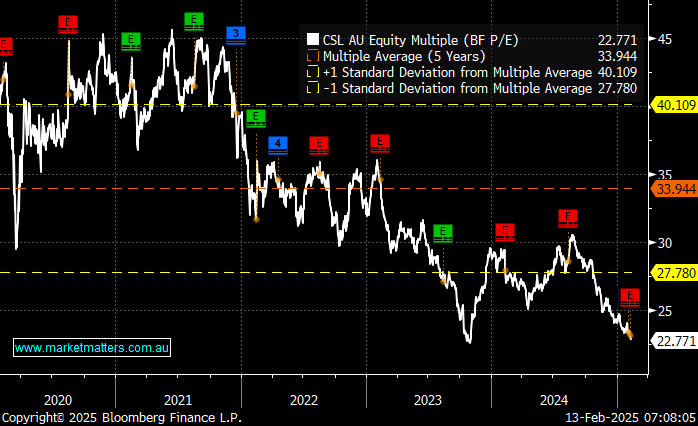

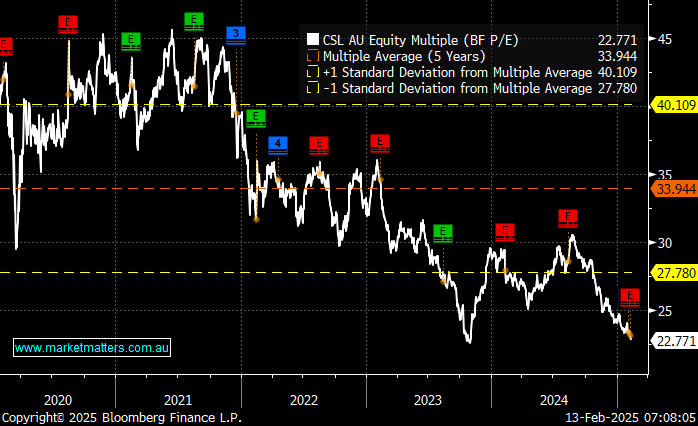

This week, CSL delivered a messy result. Although they did say they are on track to achieve FY guidance, gross margins and 1H adjusted net profits came in below expectations. The subsequent sell-off was particularly noticeable, with the stock already trading on its lowest multiple in more than five years. Valuations are becoming increasingly stretched in both directions. It’s not just the banks on the upside as the momentum trade reigns supreme.

Not surprisingly, earnings estimates are also trending lower for CSL, and it will require a meaningful improvement moving forward to arrest the recent underperformance. When companies become this large in a specific area, they feel like an oil tanker in terms of how quickly they can turn things around. In hindsight, CSL has spent four years treading water, and it feels/looks like some investors are losing patience—we understand!

- Even while it’s relatively cheap we cannot see a catalyst for a bullish rerating of CSL – MM owns in its Active Growth Portfolio.

Hence, this morning, we’ve looked at three alternative ASX healthcare plays as we consider switching from sleeping giant CSL. However, we are conscious that the US healthcare sector has also been underperforming of late, trading sideways since early 2024. We didn’t revisit Fisher & Paykel (FPH) looked at earlier this month, but we still like the stock in the $28-29 region.

NB Even after recent market moves, the ASX200 sector represents ~9% of the main index with CSL clearly a large portion of this.